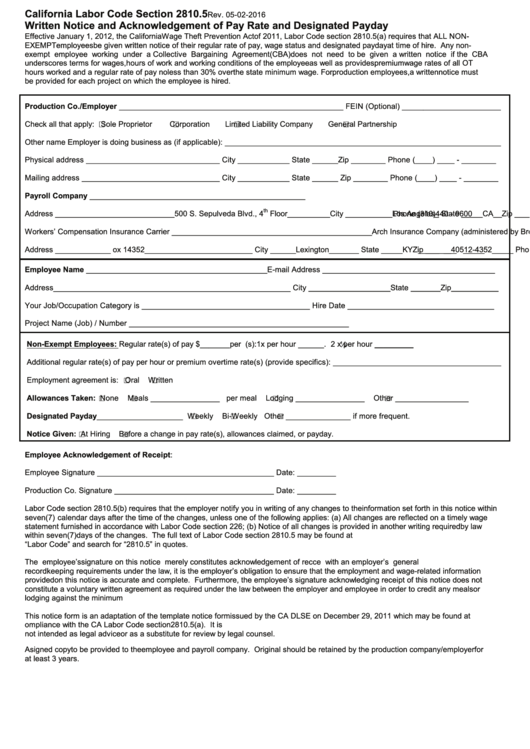

California Labor Code Section 2810.5

Rev. 05-02-2016

Written Notice and Acknowledgement of Pay Rate and Designated Payday

Effective January 1, 2012, the California Wage Theft Prevention Act of 2011, Labor Code section 2810.5(a) requires that ALL NON-

EXEMPT employees be given written notice of their regular rate of pay, wage status and designated payday at time of hire. Any non-

exempt employee working under a Collective Bargaining Agreement (CBA) does not need to be given a written notice if the CBA

underscores terms for wages, hours of work and working conditions of the employee as well as provides premium wage rates of all OT

hours worked and a regular rate of pay no less than 30% over the state minimum wage. For production employees, a written notice must

be provided for each project on which the employee is hired.

Production Co./Employer ____________________________________________________ FEIN (Optional) _______________________

Check all that apply:

Sole Proprietor

Corporation

Limited Liability Company

General Partnership

Other name Employer is doing business as (if applicable): ________________________________________________________________

Physical address _______________________________ City ____________ State ______ Zip ________ Phone (____) ____ - ________

Mailing address ________________________________ City ____________ State ______ Zip ________ Phone (____) ____ - ________

Payroll Company __________________________________________________

th

Address ____________________________

500 S. Sepulveda Blvd., 4

Floor__________ City ___________

Los Angeles_ State _____

CA__ Zip ______

90049__

Phone (310) 440 - 9600

_____ ___ _____

Workers’ Compensation Insurance Carrier _______________________________________________

Arch Insurance Company (administered by Broadspire)__

Address _____________

P.O. Box 14352 _ _______________________ _ City ____ __

Lexington

_______ State ____ _

KY Zip _ _____

40512-4352

_____ Phone (310) 440 - 9691

_____ ___ _____

Employee Name __________________________________________ E-mail Address ________________________________________

Address_______________________________________________________ City ___________________State _______Zip___________

Your Job/Occupation Category is _______________________________________

Hire Date __________________________________

Project Name (Job) / Number ___________________________________________________

Non-Exempt Employees: Regular rate(s) of pay $_______ per hour. Overtime rate(s): 1

x per hour ______. 2 x per hour _________

Additional regular rate(s) of pay per hour or premium overtime rate(s) (provide specifics): _______________________________________

Employment agreement is:

Oral

Written

Allowances Taken:

None

Meals __ ______________ per meal

Lodging ________________

Other _________________

Designated Payday ____________________

Weekly

Bi-Weekly

Other _______________ if more frequent.

Notice Given:

At Hiring

Before a change in pay rate(s), allowances claimed, or payday.

Employee Acknowledgement of Receipt:

Employee Signature _________________________________________ Date: _________

Production Co. Signature _____________________________________ Date: _________

Labor Code section 2810.5(b) requires that the employer notify you in writing of any changes to the information set forth in this notice within

seven (7) calendar days after the time of the changes, unless one of the following applies: (a) All changes are reflected on a timely wage

statement furnished in accordance with Labor Code section 226; (b) Notice of all changes is provided in another writing required by law

within seven (7) days of the changes. The full text of Labor Code section 2810.5 may be found at Check

“Labor Code” and search for “2810.5” in quotes.

The employee’s signature on this notice merely constitutes acknowledgement of receipt. In accordance with an employer’s general

recordkeeping requirements under the law, it is the employer’s obligation to ensure that the employment and wage-related information

provided on this notice is accurate and complete. Furthermore, the employee’s signature acknowledging receipt of this notice does not

constitute a voluntary written agreement as required under the law between the employer and employee in order to credit any meals or

lodging against the minimum wage. Any such voluntary written agreement must be evidenced by a separate document.

This notice form is an adaptation of the template notice form issued by the CA DLSE on December 29, 2011 which may be found at

This notice form is made available as an aid to be in compliance with the CA Labor Code section 2810.5(a). It is

not intended as legal advice or as a substitute for review by legal counsel.

A signed copy to be provided to the employee and payroll company. Original should be retained by the production company/employer for

at least 3 years.

1

1