Notice Of Quarterly Payment Due On Declaration Of Estimated Tax Form - City Of Forest Park - Income Tax Division

ADVERTISEMENT

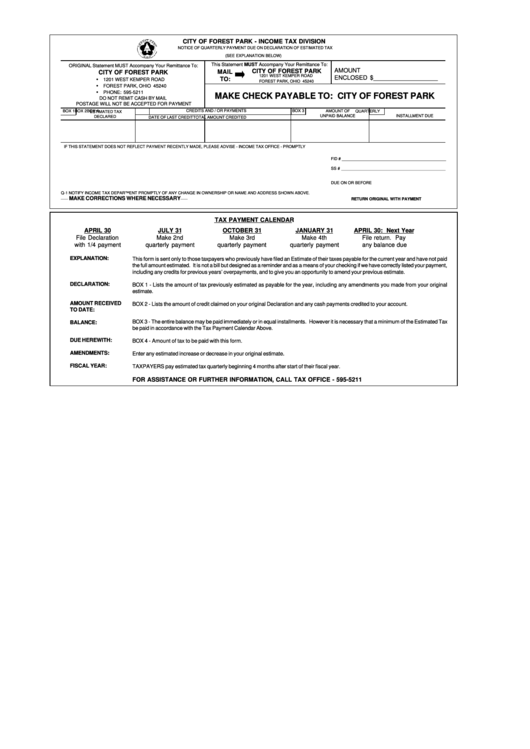

CITY OF FOREST PARK - INCOME TAX DIVISION

NOTICE OF QUARTERLY PAYMENT DUE ON DECLARATION OF ESTIMATED TAX

(SEE EXPLANATION BELOW)

This Statement MUST Accompany Your Remittance To:

ORIGINAL Statement MUST Accompany Your Remittance To:

AMOUNT

CITY OF FOREST PARK

MAIL

CITY OF FOREST PARK

1201 WEST KEMPER ROAD

ENCLOSED $___________________

TO:

•

1201 WEST KEMPER ROAD

FOREST PARK, OHIO 45240

•

FOREST PARK, OHIO 45240

•

PHONE: 595-5211

MAKE CHECK PAYABLE TO: CITY OF FOREST PARK

DO NOT REMIT CASH BY MAIL

POSTAGE WILL NOT BE ACCEPTED FOR PAYMENT

BOX 1

BOX 2

CREDITS AND / OR PAYMENTS

BOX 3

BOX 4

AMOUNT OF

QUARTERLY

ESTIMATED TAX

UNPAID BALANCE

INSTALLMENT DUE

DECLARED

DATE OF LAST CREDIT

TOTAL AMOUNT CREDITED

IF THIS STATEMENT DOES NOT REFLECT PAYMENT RECENTLY MADE, PLEASE ADVISE - INCOME TAX OFFICE - PROMPTLY

FID # ______________________________________________

SS # ______________________________________________

DUE ON OR BEFORE

Q-1 NOTIFY INCOME TAX DEPARTMENT PROMPTLY OF ANY CHANGE IN OWNERSHIP OR NAME AND ADDRESS SHOWN ABOVE.

MAKE CORRECTIONS WHERE NECESSARY

_____

_____

RETURN ORIGINAL WITH PAYMENT

TAX PAYMENT CALENDAR

APRIL 30

JULY 31

OCTOBER 31

JANUARY 31

APRIL 30: Next Year

File Declaration

Make 2nd

Make 3rd

Make 4th

File return. Pay

with 1/4 payment

quarterly payment

quarterly payment

quarterly payment

any balance due

EXPLANATION:

This form is sent only to those taxpayers who previously have filed an Estimate of their taxes payable for the current year and have not paid

the full amount estimated. It is not a bill but designed as a reminder and as a means of your checking if we have correctly listed your payment,

including any credits for previous years’ overpayments, and to give you an opportunity to amend your previous estimate.

DECLARATION:

BOX 1 - Lists the amount of tax previously estimated as payable for the year, including any amendments you made from your original

estimate.

AMOUNT RECEIVED

BOX 2 - Lists the amount of credit claimed on your original Declaration and any cash payments credited to your account.

TO DATE:

BOX 3 - The entire balance may be paid immediately or in equal installments. However it is necessary that a minimum of the Estimated Tax

BALANCE:

be paid in accordance with the Tax Payment Calendar Above.

DUE HEREWITH:

BOX 4 - Amount of tax to be paid with this form.

AMENDMENTS:

Enter any estimated increase or decrease in your original estimate.

FISCAL YEAR:

TAXPAYERS pay estimated tax quarterly beginning 4 months after start of their fiscal year.

FOR ASSISTANCE OR FURTHER INFORMATION, CALL TAX OFFICE - 595-5211

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1