Form Ir - Income Tax Return - City Of Forest Park - Income Tax Division

ADVERTISEMENT

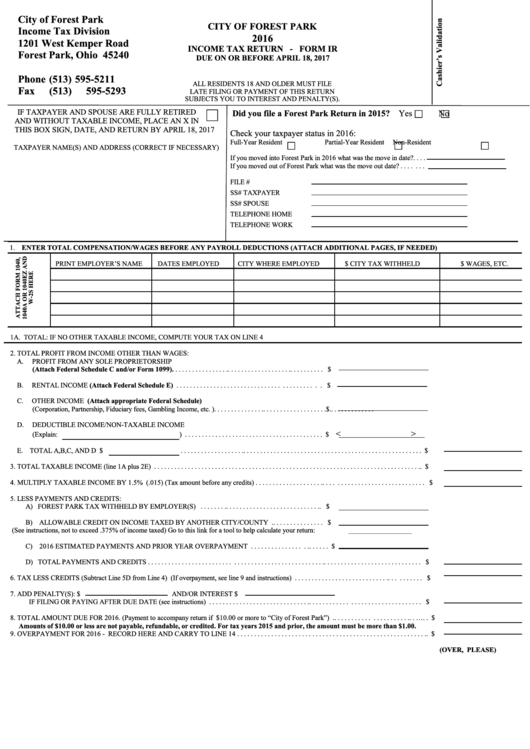

City of Forest Park

CITY OF FOREST PARK

Income Tax Division

2016

1201 West Kemper Road

INCOME TAX RETURN - FORM IR

Forest Park, Ohio 45240

DUE ON OR BEFORE APRIL 18, 2017

Phone (513) 595-5211

ALL RESIDENTS 18 AND OLDER MUST FILE

Fax

(513) 595-5293

LATE FILING OR PAYMENT OF THIS RETURN

SUBJECTS YOU TO INTEREST AND PENALTY(S).

IF TAXPAYER AND SPOUSE ARE FULLY RETIRED

Did you file a Forest Park Return in 2015? Yes

No

AND WITHOUT TAXABLE INCOME, PLACE AN X IN

THIS BOX SIGN, DATE, AND RETURN BY APRIL 18, 2017

Check your taxpayer status in 2016:

Full-Year Resident

Partial-Year Resident

Non-Resident

TAXPAYER NAME(S) AND ADDRESS (CORRECT IF NECESSARY)

If you moved into Forest Park in 2016 what was the move in date?. . . .

If you moved out of Forest Park what was the move out date? . . . . . . .

FILE #

SS# TAXPAYER

SS# SPOUSE

TELEPHONE HOME

TELEPHONE WORK

1.

ENTER TOTAL COMPENSATION/WAGES BEFORE ANY PAYROLL DEDUCTIONS (ATTACH ADDITIONAL PAGES, IF NEEDED)

PRINT EMPLOYER’S NAME

DATES EMPLOYED

CITY WHERE EMPLOYED

$ CITY TAX WITHHELD

$ WAGES, ETC.

1A. TOTAL: IF NO OTHER TAXABLE INCOME, COMPUTE YOUR TAX ON LINE 4

2. TOTAL PROFIT FROM INCOME OTHER THAN WAGES:

A.

PROFIT FROM ANY SOLE PROPRIETORSHIP

(Attach Federal Schedule C and/or Form 1099). . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . .. . . . . . . . . . $

B.

RENTAL INCOME (Attach Federal Schedule E) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

C.

OTHER INCOME (Attach appropriate Federal Schedule)

(Corporation, Partnership, Fiduciary fees, Gambling Income, etc. ). . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . .$.. . . . . . . . . . . . .

D.

DEDUCTIBLE INCOME/NON-TAXABLE INCOME

<

>

(Explain:

) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

E. TOTAL A,B,C, AND D $

. . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

3. TOTAL TAXABLE INCOME (line 1A plus 2E) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. $

4. MULTIPLY TAXABLE INCOME BY 1.5% (.015) (Tax amount before any credits) . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

5. LESS PAYMENTS AND CREDITS:

A) FOREST PARK TAX WITHHELD BY EMPLOYER(S) . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . .. $

B) ALLOWABLE CREDIT ON INCOME TAXED BY ANOTHER CITY/COUNTY .. . . . . . . . . . . . . . . $

(See instructions, not to exceed .375% of income taxed) Go to this link for a tool to help calculate your return:

C) 2016 ESTIMATED PAYMENTS AND PRIOR YEAR OVERPAYMENT . . . . . . . . . . . . . . . . .. . . . . . $

D) TOTAL PAYMENTS AND CREDITS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

6. TAX LESS CREDITS (Subtract Line 5D from Line 4) (If overpayment, see line 9 and instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . $

7. ADD PENALTY(S): $

AND/OR INTEREST $

IF FILING OR PAYING AFTER DUE DATE (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

8. TOTAL AMOUNT DUE FOR 2016. (Payment to accompany return if $10.00 or more to “City of Forest Park”) .. . . . . . . . . . . . . . . . . . . . . .. . …. . $

Amounts of $10.00 or less are not payable, refundable, or credited. For tax years 2015 and prior, the amount must be more than $1.00.

9. OVERPAYMENT FOR 2016 - RECORD HERE AND CARRY TO LINE 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. $

(OVER, PLEASE)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5