Form Er - Extension Request Form - City Of Loveland - Income Tax Department

ADVERTISEMENT

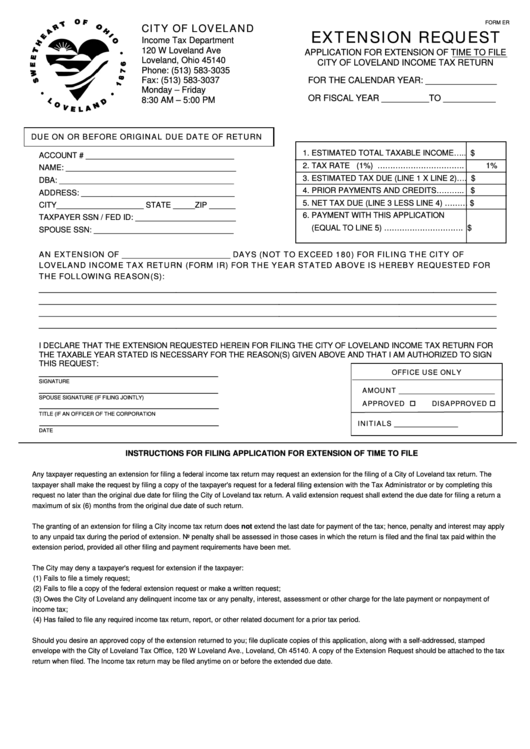

CITY OF LOVELAND

FORM ER

EXTENSION REQUEST

Income Tax Department

120 W Loveland Ave

APPLICATION FOR EXTENSION OF TIME TO FILE

Loveland, Ohio 45140

CITY OF LOVELAND INCOME TAX RETURN

Phone: (513) 583-3035

Fax: (513) 583-3037

FOR THE CALENDAR YEAR: _______________

Monday – Friday

OR FISCAL YEAR __________TO ___________

8:30 AM – 5:00 PM

DUE ON OR BEFORE ORIGINAL DUE DATE OF RETURN

1. ESTIMATED TOTAL TAXABLE INCOME….. $

ACCOUNT # __________________________________

2. TAX RATE (1%) …………………………….

1%

NAME: _______________________________________

3. ESTIMATED TAX DUE (LINE 1 X LINE 2)…. $

DBA: ________________________________________

4. PRIOR PAYMENTS AND CREDITS……….. $

ADDRESS: ___________________________________

5. NET TAX DUE (LINE 3 LESS LINE 4) ……… $

CITY____________________ STATE _____ZIP ______

6. PAYMENT WITH THIS APPLICATION

TAXPAYER SSN / FED ID: _______________________

(EQUAL TO LINE 5) …………………………. $

SPOUSE SSN: ________________________________

AN EXTENSION OF ___________________________ DAYS (NOT TO EXCEED 180) FOR FILING THE CITY OF

LOVELAND INCOME TAX RETURN (FORM IR) FOR THE YEAR STATED ABOVE IS HEREBY REQUESTED FOR

THE FOLLOWING REASON(S):

________________________________________________________________________________

________________________________________________________________________________

________________________________________________________________________________

________________________________________________________________________________

I DECLARE THAT THE EXTENSION REQUESTED HEREIN FOR FILING THE CITY OF LOVELAND INCOME TAX RETURN FOR

THE TAXABLE YEAR STATED IS NECESSARY FOR THE REASON(S) GIVEN ABOVE AND THAT I AM AUTHORIZED TO SIGN

THIS REQUEST:

OFFICE USE ONLY

SIGNATURE

AMOUNT ___________________________

SPOUSE SIGNATURE (IF FILING JOINTLY)

APPROVED

DISAPPROVED

TITLE (IF AN OFFICER OF THE CORPORATION

INITIALS __________________

DATE

INSTRUCTIONS FOR FILING APPLICATION FOR EXTENSION OF TIME TO FILE

Any taxpayer requesting an extension for filing a federal income tax return may request an extension for the filing of a City of Loveland tax return. The

taxpayer shall make the request by filing a copy of the taxpayer's request for a federal filing extension with the Tax Administrator or by completing this

request no later than the original due date for filing the City of Loveland tax return. A valid extension request shall extend the due date for filing a return a

maximum of six (6) months from the original due date of such return.

The granting of an extension for filing a City income tax return does not extend the last date for payment of the tax; hence, penalty and interest may apply

to any unpaid tax during the period of extension. No penalty shall be assessed in those cases in which the return is filed and the final tax paid within the

extension period, provided all other filing and payment requirements have been met.

The City may deny a taxpayer's request for extension if the taxpayer:

(1) Fails to file a timely request;

(2) Fails to file a copy of the federal extension request or make a written request;

(3) Owes the City of Loveland any delinquent income tax or any penalty, interest, assessment or other charge for the late payment or nonpayment of

income tax;

(4) Has failed to file any required income tax return, report, or other related document for a prior tax period.

Should you desire an approved copy of the extension returned to you; file duplicate copies of this application, along with a self-addressed, stamped

envelope with the City of Loveland Tax Office, 120 W Loveland Ave., Loveland, Oh 45140. A copy of the Extension Request should be attached to the tax

return when filed. The Income tax return may be filed anytime on or before the extended due date.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1