Refund Request Form - City Of Centerville Income Tax Department

ADVERTISEMENT

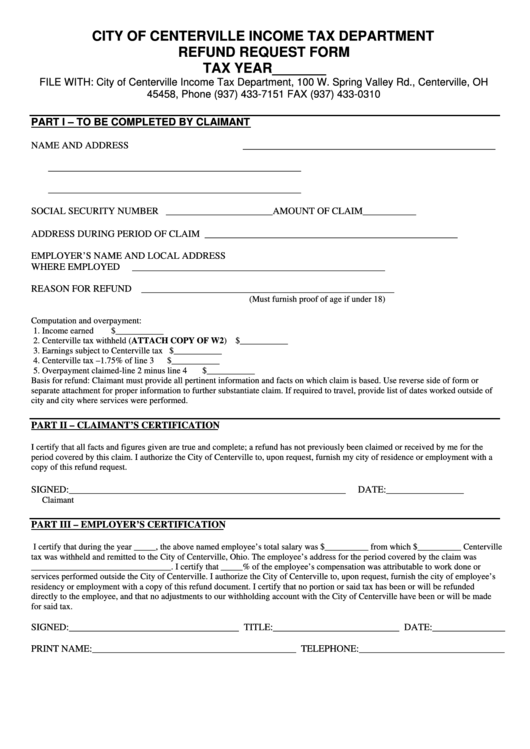

CITY OF CENTERVILLE INCOME TAX DEPARTMENT

REFUND REQUEST FORM

TAX YEAR_______

FILE WITH: City of Centerville Income Tax Department, 100 W. Spring Valley Rd., Centerville, OH

45458, Phone (937) 433-7151 FAX (937) 433-0310

PART I – TO BE COMPLETED BY CLAIMANT

NAME AND ADDRESS

____________________________________________________

____________________________________________________

____________________________________________________

SOCIAL SECURITY NUMBER

______________________AMOUNT OF CLAIM___________

ADDRESS DURING PERIOD OF CLAIM

____________________________________________________

EMPLOYER’S NAME AND LOCAL ADDRESS

WHERE EMPLOYED

____________________________________________________

REASON FOR REFUND

____________________________________________________

(Must furnish proof of age if under 18)

Computation and overpayment:

1. Income earned

$___________

2. Centerville tax withheld (ATTACH COPY OF W2)

$___________

3. Earnings subject to Centerville tax

$___________

4. Centerville tax –1.75% of line 3

$___________

5. Overpayment claimed-line 2 minus line 4

$___________

Basis for refund: Claimant must provide all pertinent information and facts on which claim is based. Use reverse side of form or

separate attachment for proper information to further substantiate claim. If required to travel, provide list of dates worked outside of

city and city where services were performed.

PART II – CLAIMANT’S CERTIFICATION

I certify that all facts and figures given are true and complete; a refund has not previously been claimed or received by me for the

period covered by this claim. I authorize the City of Centerville to, upon request, furnish my city of residence or employment with a

copy of this refund request.

SIGNED:_________________________________________________________

DATE:________________

Claimant

PART III – EMPLOYER’S CERTIFICATION

I certify that during the year _____, the above named employee’s total salary was $__________ from which $__________ Centerville

tax was withheld and remitted to the City of Centerville, Ohio. The employee’s address for the period covered by the claim was

________________________________. I certify that _____% of the employee’s compensation was attributable to work done or

services performed outside the City of Centerville. I authorize the City of Centerville to, upon request, furnish the city of employee’s

residency or employment with a copy of this refund document. I certify that no portion or said tax has been or will be refunded

directly to the employee, and that no adjustments to our withholding account with the City of Centerville have been or will be made

for said tax.

SIGNED:___________________________________ TITLE:__________________________ DATE:_______________

PRINT NAME:__________________________________________ TELEPHONE:______________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1