Food And Beverage Tax Form - Virginia Commissioner Of The Revenue

ADVERTISEMENT

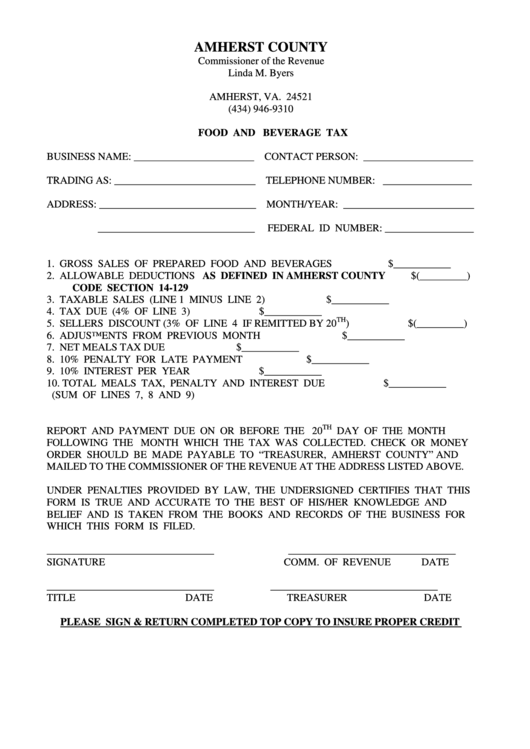

AMHERST COUNTY

Commissioner of the Revenue

Linda M. Byers

P.O. Box 719

AMHERST, VA. 24521

(434) 946-9310

FOOD AND BEVERAGE TAX

BUSINESS NAME: _______________________ CONTACT PERSON: _____________________

TRADING AS: ___________________________ TELEPHONE NUMBER: _________________

ADDRESS: ______________________________ MONTH/YEAR: _________________________

______________________________

FEDERAL ID NUMBER: _________________

1. GROSS SALES OF PREPARED FOOD AND BEVERAGES

$___________

2. ALLOWABLE DEDUCTIONS AS DEFINED IN AMHERST COUNTY

$(_________)

CODE SECTION 14-129

3. TAXABLE SALES (LINE 1 MINUS LINE 2)

$___________

4. TAX DUE (4% OF LINE 3)

$___________

TH

5. SELLERS DISCOUNT (3% OF LINE 4 IF REMITTED BY 20

)

$(_________)

6. ADJUSTMENTS FROM PREVIOUS MONTH

$___________

7. NET MEALS TAX DUE

$___________

8. 10% PENALTY FOR LATE PAYMENT

$___________

9. 10% INTEREST PER YEAR

$___________

10. TOTAL MEALS TAX, PENALTY AND INTEREST DUE

$___________

(SUM OF LINES 7, 8 AND 9)

TH

REPORT AND PAYMENT DUE ON OR BEFORE THE 20

DAY OF THE MONTH

FOLLOWING THE MONTH WHICH THE TAX WAS COLLECTED. CHECK OR MONEY

ORDER SHOULD BE MADE PAYABLE TO “TREASURER, AMHERST COUNTY” AND

MAILED TO THE COMMISSIONER OF THE REVENUE AT THE ADDRESS LISTED ABOVE.

UNDER PENALTIES PROVIDED BY LAW, THE UNDERSIGNED CERTIFIES THAT THIS

FORM IS TRUE AND ACCURATE TO THE BEST OF HIS/HER KNOWLEDGE AND

BELIEF AND IS TAKEN FROM THE BOOKS AND RECORDS OF THE BUSINESS FOR

WHICH THIS FORM IS FILED.

________________________________

________________________________

SIGNATURE

COMM. OF REVENUE

DATE

________________________________

________________________________

TITLE

DATE

TREASURER

DATE

PLEASE SIGN & RETURN COMPLETED TOP COPY TO INSURE PROPER CREDIT

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1