Food And Beverage Tax Form - 2014

ADVERTISEMENT

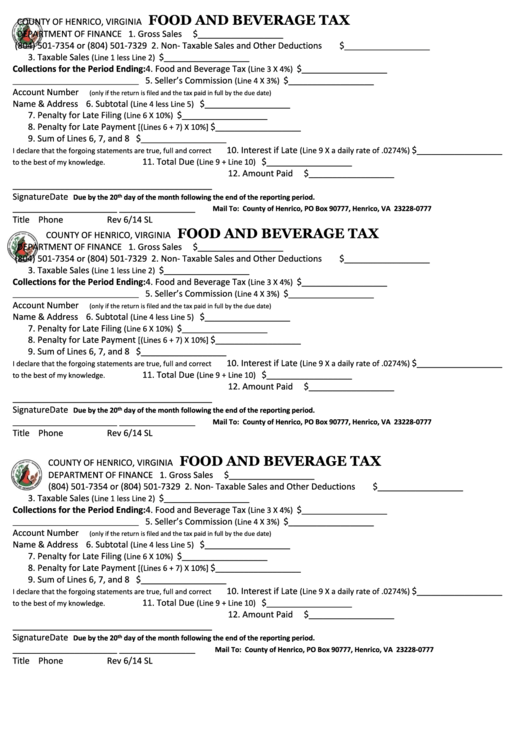

FOOD AND BEVERAGE TAX

COUNTY OF HENRICO, VIRGINIA

DEPARTMENT OF FINANCE

1. Gross Sales

$__________________

(804) 501-7354 or (804) 501-7329

2. Non- Taxable Sales and Other Deductions

$__________________

3. Taxable Sales

$__________________

(Line 1 less Line 2)

Collections for the Period Ending:

4. Food and Beverage Tax

$__________________

(Line 3 X 4%)

5. Seller’s Commission

$__________________

(Line 4 X 3%)

_____________________________________

Account Number

(only if the return is filed and the tax paid in full by the due date)

Name & Address

6. Subtotal

$__________________

(Line 4 less Line 5)

7. Penalty for Late Filing

$__________________

(Line 6 X 10%)

8. Penalty for Late Payment

$__________________

[(Lines 6 + 7) X 10%]

9. Sum of Lines 6, 7, and 8

$__________________

10. Interest if Late

$__________________

(Line 9 X a daily rate of .0274%)

I declare that the forgoing statements are true, full and correct

11. Total Due

$__________________

(Line 9 + Line 10)

to the best of my knowledge.

12. Amount Paid

$__________________

__________________________________________

Signature

Date

th

Due by the 20

day of the month following the end of the reporting period.

______________________

________________

Mail To: County of Henrico, PO Box 90777, Henrico, VA 23228-0777

Title

Phone

Rev 6/14 SL

FOOD AND BEVERAGE TAX

COUNTY OF HENRICO, VIRGINIA

DEPARTMENT OF FINANCE

1. Gross Sales

$__________________

(804) 501-7354 or (804) 501-7329

2. Non- Taxable Sales and Other Deductions

$__________________

3. Taxable Sales

$__________________

(Line 1 less Line 2)

Collections for the Period Ending:

4. Food and Beverage Tax

$__________________

(Line 3 X 4%)

5. Seller’s Commission

$__________________

(Line 4 X 3%)

_____________________________________

Account Number

(only if the return is filed and the tax paid in full by the due date)

Name & Address

6. Subtotal

$__________________

(Line 4 less Line 5)

7. Penalty for Late Filing

$__________________

(Line 6 X 10%)

8. Penalty for Late Payment

$__________________

[(Lines 6 + 7) X 10%]

9. Sum of Lines 6, 7, and 8

$__________________

10. Interest if Late

$__________________

(Line 9 X a daily rate of .0274%)

I declare that the forgoing statements are true, full and correct

11. Total Due

$__________________

(Line 9 + Line 10)

to the best of my knowledge.

12. Amount Paid

$__________________

__________________________________________

Signature

Date

Due by the 20

th

day of the month following the end of the reporting period.

______________________

________________

Mail To: County of Henrico, PO Box 90777, Henrico, VA 23228-0777

Title

Phone

Rev 6/14 SL

FOOD AND BEVERAGE TAX

COUNTY OF HENRICO, VIRGINIA

DEPARTMENT OF FINANCE

1. Gross Sales

$__________________

(804) 501-7354 or (804) 501-7329

2. Non- Taxable Sales and Other Deductions

$__________________

3. Taxable Sales

$__________________

(Line 1 less Line 2)

Collections for the Period Ending:

4. Food and Beverage Tax

$__________________

(Line 3 X 4%)

5. Seller’s Commission

$__________________

(Line 4 X 3%)

_____________________________________

Account Number

(only if the return is filed and the tax paid in full by the due date)

Name & Address

6. Subtotal

$__________________

(Line 4 less Line 5)

7. Penalty for Late Filing

$__________________

(Line 6 X 10%)

8. Penalty for Late Payment

$__________________

[(Lines 6 + 7) X 10%]

9. Sum of Lines 6, 7, and 8

$__________________

10. Interest if Late

$__________________

(Line 9 X a daily rate of .0274%)

I declare that the forgoing statements are true, full and correct

11. Total Due

$__________________

(Line 9 + Line 10)

to the best of my knowledge.

12. Amount Paid

$__________________

__________________________________________

Signature

Date

Due by the 20

th

day of the month following the end of the reporting period.

______________________

________________

Mail To: County of Henrico, PO Box 90777, Henrico, VA 23228-0777

Title

Phone

Rev 6/14 SL

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1