HSA Payroll Deduction Form

Name: ________________________________________________________________________

Street Address: _________________________________________________________________

City: _____________________________State: ____________________ Zip Code: __________

Home Phone: (_____) ____________________ Work Phone: (_____) _____________________

SSN: _____________________ Date of Birth: ______________ Date of Hire: ______________

I elect an annual contribution of $________________ for calendar year 20___.*

-

Do Not include the GT seed contribution amount

-

The annual amount elected will be divided equally among your remaining payroll periods for the

calendar year. This amount should include any previous contributions for the calendar year.

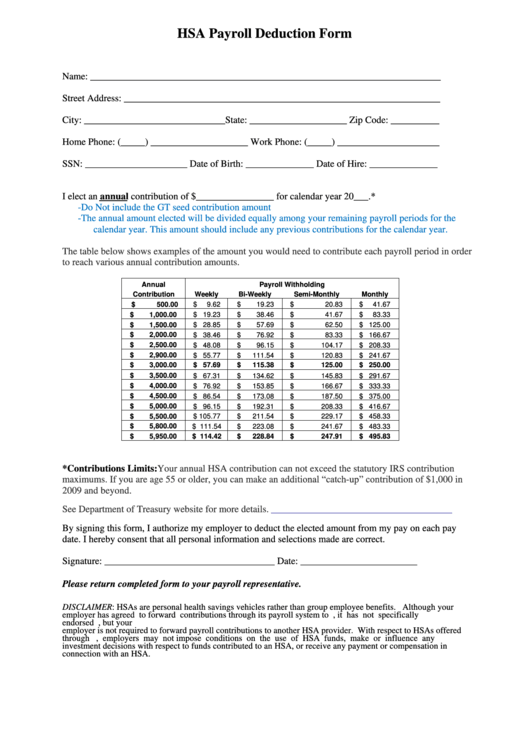

The table below shows examples of the amount you would need to contribute each payroll period in order

to reach various annual contribution amounts.

Annual

Payroll Withholding

Contribution

Weekly

Bi-Weekly

Semi-Monthly

Monthly

$

500.00

$

9.62

$

19.23

$

20.83

$

41.67

$

1,000.00

$ 19.23

$

38.46

$

41.67

$

83.33

$

1,500.00

$ 28.85

$

57.69

$

62.50

$ 125.00

$

2,000.00

$ 38.46

$

76.92

$

83.33

$ 166.67

$

2,500.00

$ 48.08

$

96.15

$

104.17

$ 208.33

$

2,900.00

$ 55.77

$

111.54

$

120.83

$ 241.67

$

3,000.00

$ 57.69

$

115.38

$

125.00

$ 250.00

$

3,500.00

$ 67.31

$

134.62

$

145.83

$ 291.67

$

4,000.00

$ 76.92

$

153.85

$

166.67

$ 333.33

$

4,500.00

$ 86.54

$

173.08

$

187.50

$ 375.00

$

5,000.00

$ 96.15

$

192.31

$

208.33

$ 416.67

$

5,500.00

$ 105.77

$

211.54

$

229.17

$ 458.33

$

5,800.00

$ 111.54

$

223.08

$

241.67

$ 483.33

$

5,950.00

$ 114.42

$

228.84

$

247.91

$ 495.83

*Contributions Limits:

Your annual HSA contribution can not exceed the statutory IRS contribution

maximums. If you are age 55 or older, you can make an additional “catch-up” contribution of $1,000 in

2009 and beyond.

See Department of Treasury website for more details.

By signing this form, I authorize my employer to deduct the elected amount from my pay on each pay

date. I hereby consent that all personal information and selections made are correct.

Signature: ___________________________________ Date: ________________________

Please return completed form to your payroll representative.

DISCLAIMER: HSAs are personal health savings vehicles rather than group employee benefits. Although your

employer has agreed to forward contributions through its payroll system to U.S. Bank, it has not specifically

endorsed U.S. Bank or any other HSA provider. You are not restricted from moving funds to another HSA, but your

employer is not required to forward payroll contributions to another HSA provider. With respect to HSAs offered

through U.S. Bank, employers may not impose conditions on the use of HSA funds, make or influence any

investment decisions with respect to funds contributed to an HSA, or receive any payment or compensation in

connection with an HSA.

1

1