City Of Kettering -Business Income Tax Registration Form

ADVERTISEMENT

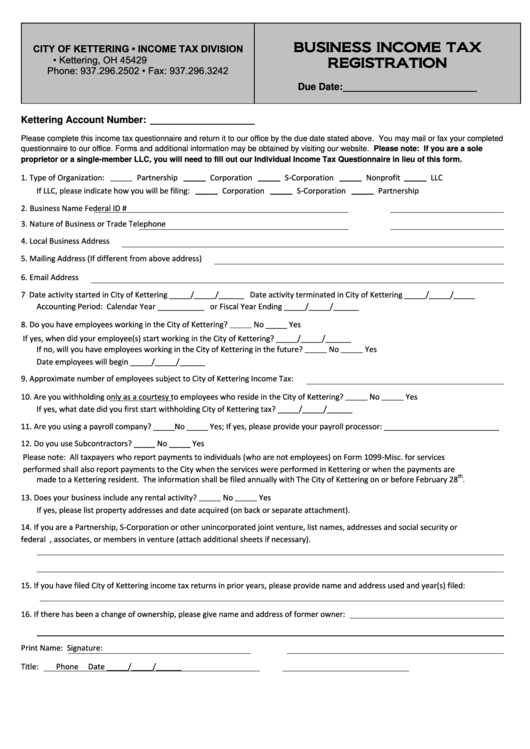

BUSINESS INCOME TAX

CITY OF KETTERING • INCOME TAX DIVISION

P.O. Box 293100 • Kettering, OH 45429

REGISTRATION

Phone: 937.296.2502 • Fax: 937.296.3242

Due Date:

Kettering Account Number:

Please complete this income tax questionnaire and return it to our office by the due date stated above. You may mail or fax your completed

questionnaire to our office. Forms and additional information may be obtained by visiting our website. Please note: If you are a sole

proprietor or a single-member LLC, you will need to fill out our Individual Income Tax Questionnaire in lieu of this form.

_____ Partnership

_____ Corporation

_____ S-Corporation

_____ Nonprofit

_____ LLC

1. Type of Organization:

_____ Corporation

_____ S-Corporation

_____ Partnership

If LLC, please indicate how you will be filing:

2.

Business Name

Federal ID #

3. Nature of Business or Trade

Telephone

4. Local Business Address

5. Mailing Address (If different from above address)

6. Email Address

7

Date activity started in City of Kettering _____/_____/______

Date activity terminated in City of Kettering _____/_____/_____

Accounting Period:

Calendar Year ___________

or Fiscal Year Ending _____/_____/______

8. Do you have employees working in the City of Kettering? _____ No _____ Yes

If yes, when did your employee(s) start working in the City of Kettering? _____/_____/______

If no, will you have employees working in the City of Kettering in the future? _____ No _____ Yes

Date employees will begin _____/_____/______

9. Approximate number of employees subject to City of Kettering Income Tax:

10. Are you withholding only as a courtesy to employees who reside in the City of Kettering? _____ No _____ Yes

If yes, what date did you first start withholding City of Kettering tax? _____/_____/______

11. Are you using a payroll company? _____No _____ Yes; If yes, please provide your payroll processor: ___________________________

12. Do you use Subcontractors? _____ No _____ Yes

Please note:

All taxpayers who report payments to individuals (who are not employees) on Form 1099-Misc. for services

performed shall also report payments to the City when the services were performed in Kettering or when the payments are

th

made to a Kettering resident.

The information shall be filed annually with The City of Kettering on or before February 28

.

13. Does your business include any rental activity? _____ No _____ Yes

If yes, please list property addresses and date acquired (on back or separate attachment).

14. If you are a Partnership, S-Corporation or other unincorporated joint venture, list names, addresses and social security or

federal I.D. numbers of all partners, associates, or members in venture (attach additional sheets if necessary).

15. If you have filed City of Kettering income tax returns in prior years, please provide name and address used and year(s) filed:

16. If there has been a change of ownership, please give name and address of former owner:

Print Name:

Signature:

Title:

Phone

Date _____/_____/______

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1