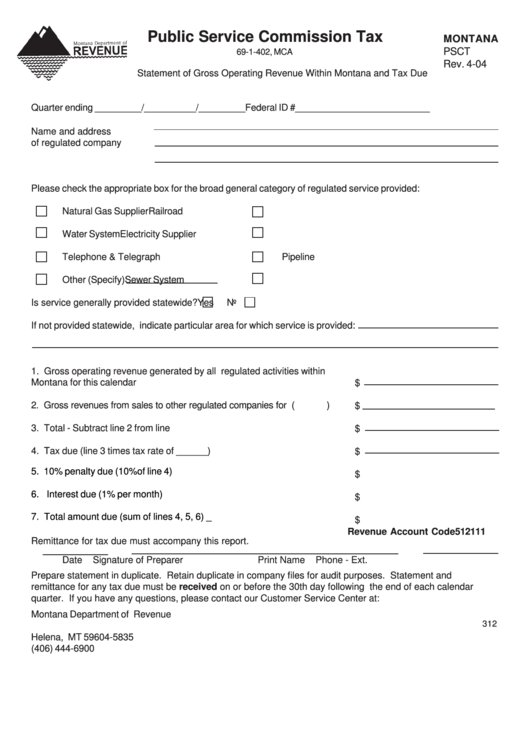

Public Service Commission Tax

MONTANA

PSCT

69-1-402, MCA

Rev. 4-04

Statement of Gross Operating Revenue Within Montana and Tax Due

Quarter ending _________/__________/_________

Federal ID #__________________________

Name and address

of regulated company

Please check the appropriate box for the broad general category of regulated service provided:

Natural Gas Supplier

Railroad

Water System

Electricity Supplier

Telephone & Telegraph

Pipeline

Other (Specify)

Sewer System

Is service generally provided statewide?

Yes

No

If not provided statewide, indicate particular area for which service is provided:

1. Gross operating revenue generated by all regulated activities within

Montana for this calendar quarter...............................................................

$

2. Gross revenues from sales to other regulated companies for resale.............

(

)

$

3. Total - Subtract line 2 from line 1..................................................................

$

4. Tax due (line 3 times tax rate of ______) ....................................................

$

5. 10% penalty due (10%of line 4)................................................................... __________________________

$

6. Interest due (1% per month)....................................................................... __________________________

$

7. Total amount due (sum of lines 4, 5, 6)........................................................ __________________________

$

Revenue Account Code

512111

Remittance for tax due must accompany this report.

Date

Signature of Preparer

Print Name

Phone - Ext.

Prepare statement in duplicate. Retain duplicate in company files for audit purposes. Statement and

remittance for any tax due must be received on or before the 30th day following the end of each calendar

quarter. If you have any questions, please contact our Customer Service Center at:

Montana Department of Revenue

312

P.O. Box 5835

Helena, MT 59604-5835

(406) 444-6900

1

1