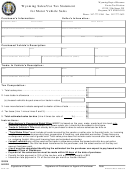

Form 17 - Wyoming Sales/use Tax Return Page 2

ADVERTISEMENT

Instructions For Filing Your Wyoming Sales/Use Tax Return ETS Form 17

Resort District Sales

Who must file a sales/use tax return? Any person making retail sales in a resort district of tangible personal property,

services or admissions that are subject to sales/use tax.

When must I file my sales/use tax return? Returns must be postmarked on or before the last day of the month (or quarter)

following the month sales were made. Example: February 2004 sales would be due on or before March 31, 2004.

Where do I send my sales/use tax return? Returns must be signed and accompanied by a check or money order payable

to the Department of Revenue, Excise Tax Division, 122 W. 25th St., Cheyenne, WY 82002-0110. Returns should be mailed in

the return envelope provided by the Department of Revenue.

Line 1: Enter the total amount of all sales, leases, rentals, and services made by your business for the reporting period

(month(s) sales were made). Do not include the amount of sales tax collected. Include sales made to yourself. This includes

all in-state inventory purchases that were used/consumed by you.

Line 2: Enter total deductions for the reporting period. (See worksheet for allowable deductions).

Line 3: Subtract line 2 from line 1 and enter result here. This is your net sales subject to sales tax. This includes lodging and resort

sales.

Section 4: Use this section to itemize sales and use tax to the county where the delivery took place outside the resort district.

Columns 4B: Enter the amount of sales subject to sales tax for each county where delivery occurred, excluding

lodging and resort sales. (Note: Columns 4B, line 6 and line 7 must equal the amount shown on line 3.)

Columns 4D: Multiply the amount in Column 4B by the rate provided in Column 4C and enter result here.

Repeat this step for each county where delivery occurred.

Line 4E:

Add all Column 4D totals and enter result here.

Line 5: Enter the total amount of excess tax collected on sales for this period.

Line 6: Enter the amount of lodging service sales in the resort district for this period in the first box. Multiply the first box

total by the lodging tax rate in the second box and enter the result in the third box on line 6.

Line 7: Enter the amount of sales tax collected within the resort district for this period. Multiply the first box total by the sales tax

rate in the second box and enter the result in the third box on line 7.

Line 8:

In the first box enter the total amount of tangible personal property purchased out of state, for consumption by your

business in the Resort District , where sales tax was not paid in the state of purchase. Multiply the first box total by the use tax rate

in the second box and enter the result in the third box on line 8. Please note that an off-setting credit will be allowed for the legally

imposed sales tax paid to another state. For example, if you pay 3% Colorado sales tax on your purchase of a computer for your

business, you will need to report an additional tax due to equal your current resort use tax rate here.

Line 9: Add lines 4E, 5, 6, 7 and 8. Enter the result here.

Line 10.

Use this line to report adjustments as described below. Do not include sales tax paid to a supplier at the

time of purchase. Adjustments include:

• Penalty for late filing (10% of the total use tax due Wyoming.);

• Interest for late filing (Rates are available on the DOR homepage at or by calling

the Department of Revenue at 307-777-5200. Field offices are also available in ten counties.);

• Credits previously established from over payment of tax and currently unused on your account. (Subtract this

figure from line 9 and enter result on line 11.)

Line 11: Add lines 9 and 10 and enter total here. This is your total tax liability for this period.

Please sign and date the return and provide a daytime telephone number.

ETS Form 17

Rev. 3/29/2007

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2