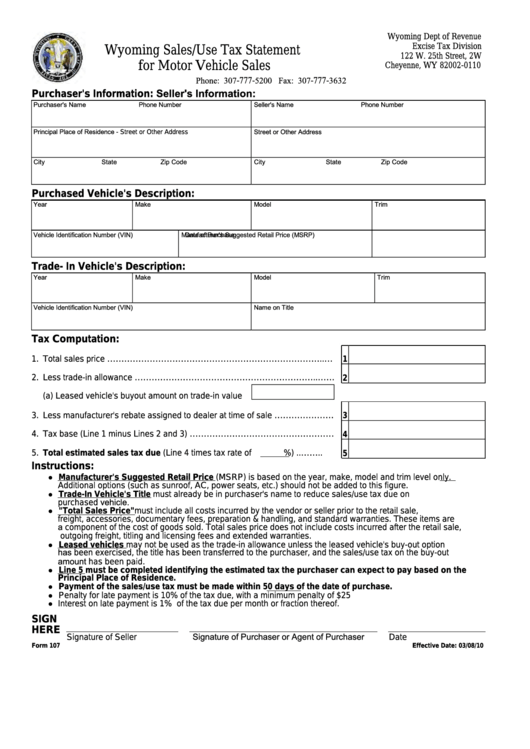

Wyoming Dept of Revenue

Excise Tax Division

Wyoming Sales/Use Tax Statement

122 W. 25th Street, 2W

for Motor Vehicle Sales

Cheyenne, WY 82002-0110

Phone: 307-777-5200 Fax: 307-777-3632

Purchaser's Information:

Seller's Information:

Purchaser's Name Phone Number

Seller's Name Phone Number

Principal Place of Residence - Street or Other Address

Street or Other Address

City State Zip Code

City State Zip Code

Purchased Vehicle's Description:

Year

Make

Model

Trim

Vehicle Identification Number (VIN)

Manufacturer's Suggested Retail Price (MSRP)

Date of Purchase

Trade- In Vehicle's Description:

Year

Make

Model

Trim

Vehicle Identification Number (VIN)

Name on Title

Tax Computation:

1.

Total sales price …………………………………………………………………..…

1

2.

Less trade-in allowance ………………………………………………………..……

2

(a) Leased vehicle's buyout amount on trade-in value

3.

Less manufacturer's rebate assigned to dealer at time of sale …………………

3

4.

Tax base (Line 1 minus Lines 2 and 3) ……………………………………………

4

5.

Total estimated sales tax due (Line 4 times tax rate of %) ..……..

5

Instructions:

Manufacturer's Suggested Retail Price (MSRP) is based on the year, make, model and trim level only.

Additional options (such as sunroof, AC, power seats, etc.) should not be added to this figure.

Trade-In Vehicle's Title must already be in purchaser's name to reduce sales/use tax due on

purchased vehicle.

"Total Sales Price" must include all costs incurred by the vendor or seller prior to the retail sale, i.e. incoming

freight, accessories, documentary fees, preparation & handling, and standard warranties. These items are

a component of the cost of goods sold. Total sales price does not include costs incurred after the retail sale,

i.e. outgoing freight, titling and licensing fees and extended warranties.

Leased vehicles may not be used as the trade-in allowance unless the leased vehicle's buy-out option

has been exercised, the title has been transferred to the purchaser, and the sales/use tax on the buy-out

amount has been paid.

Line 5 must be completed identifying the estimated tax the purchaser can expect to pay based on the

Principal Place of Residence.

Payment of the sales/use tax must be made within 50 days of the date of purchase.

Penalty for late payment is 10% of the tax due, with a minimum penalty of $25

Interest on late payment is 1% of the tax due per month or fraction thereof.

SIGN

HERE

Signature of Seller

Signature of Purchaser or Agent of Purchaser

Date

Form 107

Effective Date: 03/08/10

1

1