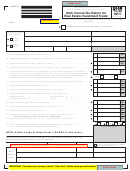

reset

To Be Completed by the Purchaser

Name of Purchaser __________________________________________ CT Tax Reg. No. ________________________

Address of Purchaser _________________________________________________________________________________

Name of Retailer ____________________________________________

CT Tax Reg. No. _______________________

Address of Retailer ___________________________________________________________________________________

Name of Lessor _____________________________________________

CT Tax Reg. No. _______________________

Address of Lessor ___________________________________________________________________________________

Description of Property Purchased ______________________________________________________________________

Date of Original Sale ______________ Date of Sale and Leaseback Contract or Binding Agreement ________________

(The sale and leaseback contract or binding agreement must be signed within 120 days of the original sale.)

Date of Sale by Purchaser to Lessor ______________________ Sale:

Has

Has Not Occurred

Date of Leaseback Commencement ______________________ Leaseback

Has

Has Not Commenced

(The sale and leaseback must begin within one year of the original sale.)

Attached:

Sale and Leaseback Contract

Binding Purchaser/Lessor Letter

Bill of Sale (if needed)

Declaration by the Purchaser

The item described above is tangible personal property that is being or has been purchased under the sale and leaseback

exclusion or refund provisions of Conn. Gen. Stat. §12-407(a)(3)(B). Check one of the following:

The sale of this item is excluded from sales and use taxes because at the time of the original sale the purchaser provided the

retailer with the required evidence that within 120 days from the sale date the purchaser will enter into a sale and leaseback

agreement with a lessor;

The sales and use taxes paid on the sale of this item are being refunded to the purchaser by the retailer because the purchaser

provided the retailer with the required evidence that within 120 days from the sale date the purchaser will or has entered into

a sale and leaseback agreement with a lessor; or

The purchaser claims a refund from DRS of the sales and use taxes paid on the sale of this item because the purchaser

provided DRS with the required evidence that within 120 days from the sale date the purchaser will or has entered into a sale

and leaseback agreement with a lessor.

The sale of the item and the commencement of the leaseback have occurred or will occur within one year of the date of the

original sale.

I, the authorized representative of the purchaser named above, declare under penalty of law that I have examined the information

in this certificate and to the best of my knowledge and belief it is true, complete, and correct. I understand the penalty for willfully

delivering a false return to DRS is a fine of not more than $5,000, or imprisonment for not more than five years, or both.

By: ________________________________________

_____________________________

_____________________

Signature of Authorized Person

Title

Date

CERT-137 (Rev. 01/05)

1

1 2

2