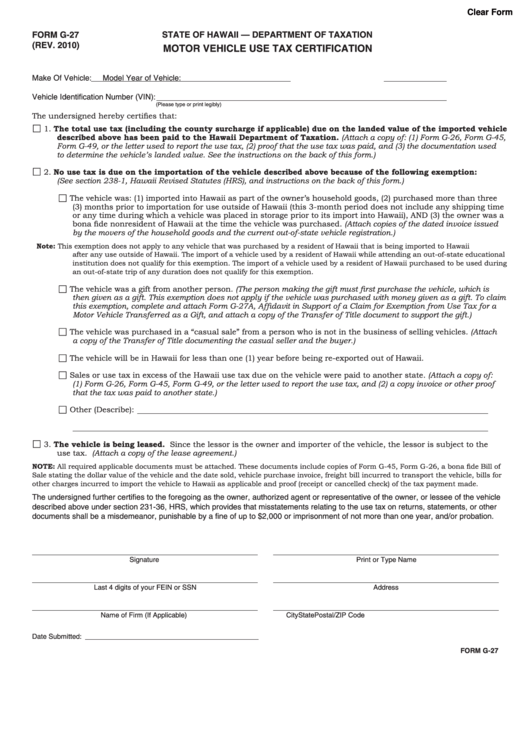

Clear Form

FORM G-27

STATE OF HAWAII — DEPARTMENT OF TAXATION

(REV. 2010)

MOTOR VEHICLE USE TAX CERTIFICATION

Make Of Vehicle:

Model Year of Vehicle:

Vehicle Identification Number (VIN):

(Please type or print legibly)

The undersigned hereby certifies that:

1. The total use tax (including the county surcharge if applicable) due on the landed value of the imported vehicle

described above has been paid to the Hawaii Department of Taxation. (Attach a copy of: (1) Form G-26, Form G-45,

Form G-49, or the letter used to report the use tax, (2) proof that the use tax was paid, and (3) the documentation used

to determine the vehicle’s landed value. See the instructions on the back of this form.)

2. No use tax is due on the importation of the vehicle described above because of the following exemption:

(See section 238-1, Hawaii Revised Statutes (HRS), and instructions on the back of this form.)

The vehicle was: (1) imported into Hawaii as part of the owner’s household goods, (2) purchased more than three

(3) months prior to importation for use outside of Hawaii (this 3-month period does not include any shipping time

or any time during which a vehicle was placed in storage prior to its import into Hawaii), AND (3) the owner was a

bona fide nonresident of Hawaii at the time the vehicle was purchased. (Attach copies of the dated invoice issued

by the movers of the household goods and the current out-of-state vehicle registration.)

Note: This exemption does not apply to any vehicle that was purchased by a resident of Hawaii that is being imported to Hawaii

after any use outside of Hawaii. The import of a vehicle used by a resident of Hawaii while attending an out-of-state educational

institution does not qualify for this exemption. The import of a vehicle used by a resident of Hawaii purchased to be used during

an out-of-state trip of any duration does not qualify for this exemption.

The vehicle was a gift from another person. (The person making the gift must first purchase the vehicle, which is

then given as a gift. This exemption does not apply if the vehicle was purchased with money given as a gift. To claim

this exemption, complete and attach Form G-27A, Affidavit in Support of a Claim for Exemption from Use Tax for a

Motor Vehicle Transferred as a Gift, and attach a copy of the Transfer of Title document to support the gift.)

The vehicle was purchased in a “casual sale” from a person who is not in the business of selling vehicles. (Attach

a copy of the Transfer of Title documenting the casual seller and the buyer.)

The vehicle will be in Hawaii for less than one (1) year before being re-exported out of Hawaii.

Sales or use tax in excess of the Hawaii use tax due on the vehicle were paid to another state. (Attach a copy of:

(1) Form G-26, Form G-45, Form G-49, or the letter used to report the use tax, and (2) a copy invoice or other proof

that the tax was paid to another state.)

Other (Describe):

3. The vehicle is being leased. Since the lessor is the owner and importer of the vehicle, the lessor is subject to the

use tax. (Attach a copy of the lease agreement.)

NOTE: All required applicable documents must be attached. These documents include copies of Form G-45, Form G-26, a bona fide Bill of

Sale stating the dollar value of the vehicle and the date sold, vehicle purchase invoice, freight bill incurred to transport the vehicle, bills for

other charges incurred to import the vehicle to Hawaii as applicable and proof (receipt or cancelled check) of the tax payment made.

The undersigned further certifies to the foregoing as the owner, authorized agent or representative of the owner, or lessee of the vehicle

described above under section 231-36, HRS, which provides that misstatements relating to the use tax on returns, statements, or other

documents shall be a misdemeanor, punishable by a fine of up to $2,000 or imprisonment of not more than one year, and/or probation.

Signature

Print or Type Name

Last 4 digits of your FEIN or SSN

Address

Name of Firm (If Applicable)

City

State

Postal/ZIP Code

Date Submitted:

FORM G-27

1

1 2

2