Form Bt-100 - Alcoholic Beverage Tax - Application For Permission To Import Into Connecticut Alcoholic Beverages

ADVERTISEMENT

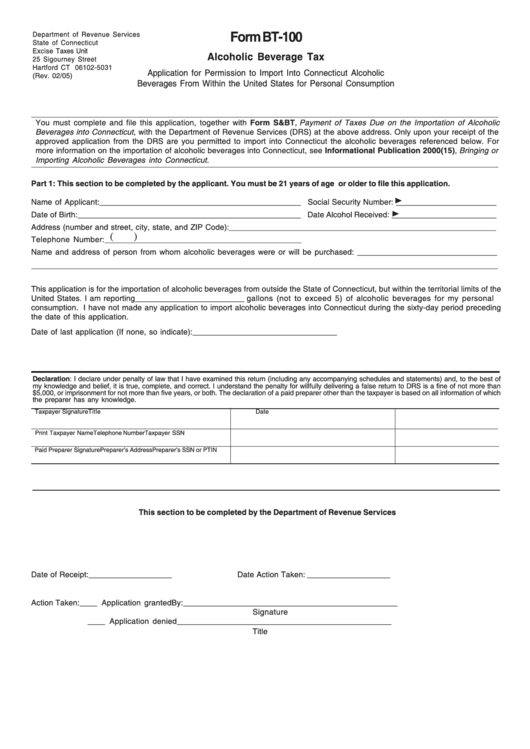

Form BT-100

Department of Revenue Services

State of Connecticut

Excise Taxes Unit

Alcoholic Beverage Tax

25 Sigourney Street

Hartford CT 06102-5031

Application for Permission to Import Into Connecticut Alcoholic

(Rev. 02/05)

Beverages From Within the United States for Personal Consumption

You must complete and file this application, together with Form S&BT, Payment of Taxes Due on the Importation of Alcoholic

Beverages into Connecticut, with the Department of Revenue Services (DRS) at the above address. Only upon your receipt of the

approved application from the DRS are you permitted to import into Connecticut the alcoholic beverages referenced below. For

more information on the importation of alcoholic beverages into Connecticut, see Informational Publication 2000(15), Bringing or

Importing Alcoholic Beverages into Connecticut.

Part 1: This section to be completed by the applicant. You must be 21 years of age or older to file this application.

Name of Applicant: ______________________________________________ Social Security Number: _______________________

Date of Birth: ___________________________________________________ Date Alcohol Received: ________________________

Address (number and street, city, state, and ZIP Code): _____________________________________________________________

(

)

Telephone Number: _____________________________________________

Name and address of person from whom alcoholic beverages were or will be purchased: ________________________________

This application is for the importation of alcoholic beverages from outside the State of Connecticut, but within the territorial limits of the

United States. I am reporting _________________________ gallons (not to exceed 5) of alcoholic beverages for my personal

consumption. I have not made any application to import alcoholic beverages into Connecticut during the sixty-day period preceding

the date of this application.

Date of last application (If none, so indicate): _________________________________

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of

my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return to DRS is a fine of not more than

$5,000, or imprisonment for not more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which

the preparer has any knowledge.

Taxpayer Signature

Title

Date

Print Taxpayer Name

Telephone Number

Taxpayer SSN

Paid Preparer Signature

Preparer’s Address

Preparer’s SSN or PTIN

This section to be completed by the Department of Revenue Services

Date of Receipt: ___________________

Date Action Taken: ___________________

Action Taken:

____ Application granted

By: _________________________________________________

Signature

____ Application denied

_________________________________________________

Title

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1