Form Mta-599 - Application For Permission To Make Metropolitan Commuter Transportation Mobility Tax Group Estimated Tax Payments And File A Group Return

ADVERTISEMENT

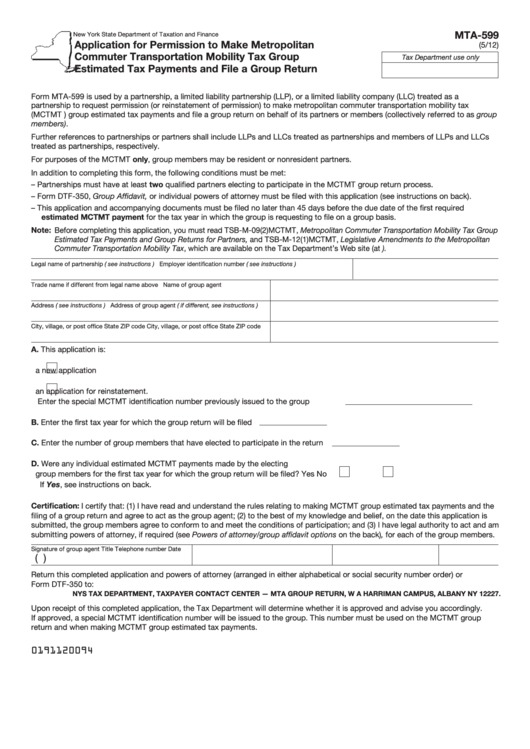

MTA-599

New York State Department of Taxation and Finance

Application for Permission to Make Metropolitan

(5/12)

Commuter Transportation Mobility Tax Group

Tax Department use only

Estimated Tax Payments and File a Group Return

Form MTA-599 is used by a partnership, a limited liability partnership (LLP), or a limited liability company (LLC) treated as a

partnership to request permission (or reinstatement of permission) to make metropolitan commuter transportation mobility tax

(MCTMT ) group estimated tax payments and file a group return on behalf of its partners or members (collectively referred to as group

members).

Further references to partnerships or partners shall include LLPs and LLCs treated as partnerships and members of LLPs and LLCs

treated as partnerships, respectively.

For purposes of the MCTMT only, group members may be resident or nonresident partners.

In addition to completing this form, the following conditions must be met:

– Partnerships must have at least two qualified partners electing to participate in the MCTMT group return process.

– Form DTF-350, Group Affidavit, or individual powers of attorney must be filed with this application (see instructions on back).

– This application and accompanying documents must be filed no later than 45 days before the due date of the first required

estimated MCTMT payment for the tax year in which the group is requesting to file on a group basis.

Note: Before completing this application, you must read TSB-M-09(2)MCTMT, Metropolitan Commuter Transportation Mobility Tax Group

Estimated Tax Payments and Group Returns for Partners, and TSB-M-12(1)MCTMT, Legislative Amendments to the Metropolitan

Commuter Transportation Mobility Tax, which are available on the Tax Department’s Web site (at ).

Legal name of partnership ( see instructions )

Employer identification number ( see instructions )

Trade name if different from legal name above

Name of group agent

Address ( see instructions )

Address of group agent ( if different, see instructions )

City, village, or post office

State

ZIP code

City, village, or post office

State

ZIP code

A. This application is:

a new application

an application for reinstatement.

Enter the special MCTMT identification number previously issued to the group

B. Enter the first tax year for which the group return will be filed

C. Enter the number of group members that have elected to participate in the return

D. Were any individual estimated MCTMT payments made by the electing

group members for the first tax year for which the group return will be filed?

Yes

No

If Yes, see instructions on back.

Certification: I certify that: (1) I have read and understand the rules relating to making MCTMT group estimated tax payments and the

filing of a group return and agree to act as the group agent; (2) to the best of my knowledge and belief, on the date this application is

submitted, the group members agree to conform to and meet the conditions of participation; and (3) I have legal authority to act and am

submitting powers of attorney, if required (see Powers of attorney/group affidavit options on the back), for each of the group members.

Signature of group agent

Title

Telephone number

Date

(

)

Return this completed application and powers of attorney (arranged in either alphabetical or social security number order) or

Form DTF-350 to:

NYS TAX DEPARTMENT, TAXPAYER CONTACT CENTER — MTA GROUP RETURN, W A HARRIMAN CAMPUS, ALBANY NY 12227.

Upon receipt of this completed application, the Tax Department will determine whether it is approved and advise you accordingly.

If approved, a special MCTMT identification number will be issued to the group. This number must be used on the MCTMT group

return and when making MCTMT group estimated tax payments.

0191120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2