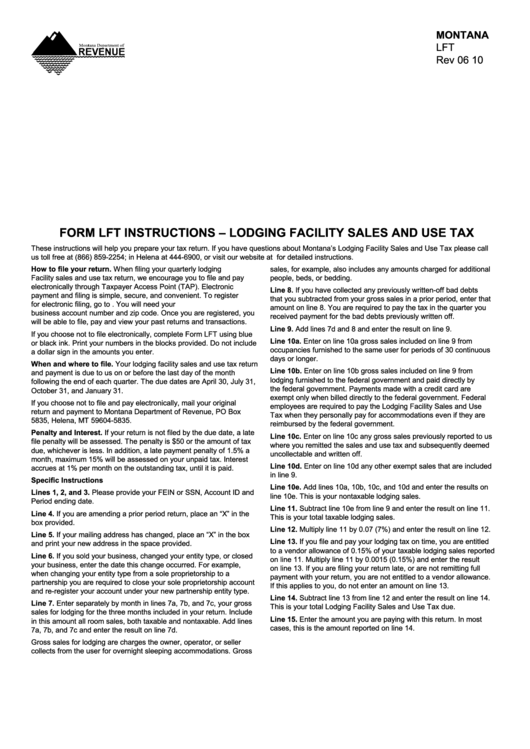

Form Lft Instructions - Lodging Facility Sales And Use Tax - 2010

ADVERTISEMENT

MONTANA

LFT

Rev 06 10

FORM LFT INSTRUCTIONS – LODGING FACILITY SALES AND USE TAX

These instructions will help you prepare your tax return. If you have questions about Montana’s Lodging Facility Sales and Use Tax please call

us toll free at (866) 859-2254; in Helena at 444-6900, or visit our website at revenue.mt.gov for detailed instructions.

How to file your return. When filing your quarterly lodging

sales, for example, also includes any amounts charged for additional

Facility sales and use tax return, we encourage you to file and pay

people, beds, or bedding.

electronically through Taxpayer Access Point (TAP). Electronic

Line 8. If you have collected any previously written-off bad debts

payment and filing is simple, secure, and convenient. To register

that you subtracted from your gross sales in a prior period, enter that

for electronic filing, go to https://tap.dor.mt.gov. You will need your

amount on line 8. You are required to pay the tax in the quarter you

business account number and zip code. Once you are registered, you

received payment for the bad debts previously written off.

will be able to file, pay and view your past returns and transactions.

Line 9. Add lines 7d and 8 and enter the result on line 9.

If you choose not to file electronically, complete Form LFT using blue

Line 10a. Enter on line 10a gross sales included on line 9 from

or black ink. Print your numbers in the blocks provided. Do not include

occupancies furnished to the same user for periods of 30 continuous

a dollar sign in the amounts you enter.

days or longer.

When and where to file. Your lodging facility sales and use tax return

Line 10b. Enter on line 10b gross sales included on line 9 from

and payment is due to us on or before the last day of the month

lodging furnished to the federal government and paid directly by

following the end of each quarter. The due dates are April 30, July 31,

the federal government. Payments made with a credit card are

October 31, and January 31.

exempt only when billed directly to the federal government. Federal

If you choose not to file and pay electronically, mail your original

employees are required to pay the Lodging Facility Sales and Use

return and payment to Montana Department of Revenue, PO Box

Tax when they personally pay for accommodations even if they are

5835, Helena, MT 59604-5835.

reimbursed by the federal government.

Penalty and Interest. If your return is not filed by the due date, a late

Line 10c. Enter on line 10c any gross sales previously reported to us

file penalty will be assessed. The penalty is $50 or the amount of tax

where you remitted the sales and use tax and subsequently deemed

due, whichever is less. In addition, a late payment penalty of 1.5% a

uncollectable and written off.

month, maximum 15% will be assessed on your unpaid tax. Interest

Line 10d. Enter on line 10d any other exempt sales that are included

accrues at 1% per month on the outstanding tax, until it is paid.

in line 9.

Specific Instructions

Line 10e. Add lines 10a, 10b, 10c, and 10d and enter the results on

Lines 1, 2, and 3. Please provide your FEIN or SSN, Account ID and

line 10e. This is your nontaxable lodging sales.

Period ending date.

Line 11. Subtract line 10e from line 9 and enter the result on line 11.

Line 4. If you are amending a prior period return, place an “X” in the

This is your total taxable lodging sales.

box provided.

Line 12. Multiply line 11 by 0.07 (7%) and enter the result on line 12.

Line 5. If your mailing address has changed, place an “X” in the box

Line 13. If you file and pay your lodging tax on time, you are entitled

and print your new address in the space provided.

to a vendor allowance of 0.15% of your taxable lodging sales reported

Line 6. If you sold your business, changed your entity type, or closed

on line 11. Multiply line 11 by 0.0015 (0.15%) and enter the result

your business, enter the date this change occurred. For example,

on line 13. If you are filing your return late, or are not remitting full

when changing your entity type from a sole proprietorship to a

payment with your return, you are not entitled to a vendor allowance.

partnership you are required to close your sole proprietorship account

If this applies to you, do not enter an amount on line 13.

and re-register your account under your new partnership entity type.

Line 14. Subtract line 13 from line 12 and enter the result on line 14.

Line 7. Enter separately by month in lines 7a, 7b, and 7c, your gross

This is your total Lodging Facility Sales and Use Tax due.

sales for lodging for the three months included in your return. Include

Line 15. Enter the amount you are paying with this return. In most

in this amount all room sales, both taxable and nontaxable. Add lines

cases, this is the amount reported on line 14.

7a, 7b, and 7c and enter the result on line 7d.

Gross sales for lodging are charges the owner, operator, or seller

collects from the user for overnight sleeping accommodations. Gross

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2