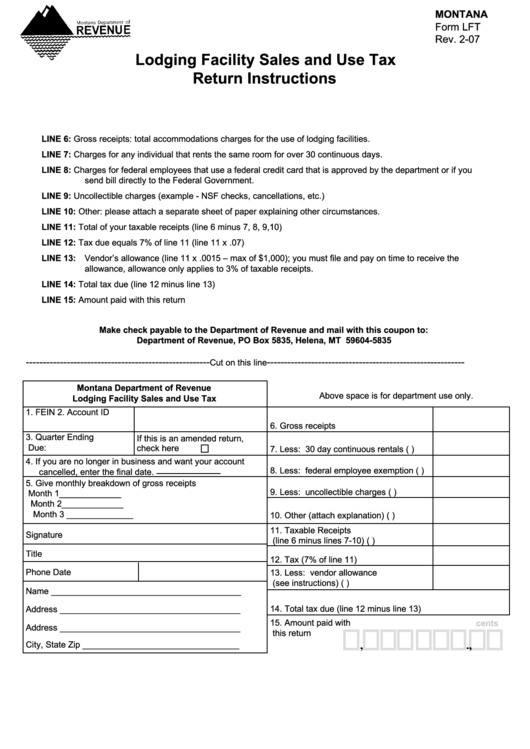

Form Lft - Lodging Facility Sales And Use Tax Return Instructions

ADVERTISEMENT

MONTANA

Form LFT

Rev. 2-07

Lodging Facility Sales and Use Tax

Return Instructions

LINE 6:

Gross receipts: total accommodations charges for the use of lodging facilities.

LINE 7:

Charges for any individual that rents the same room for over 30 continuous days.

LINE 8:

Charges for federal employees that use a federal credit card that is approved by the department or if you

send bill directly to the Federal Government.

LINE 9:

Uncollectible charges (example - NSF checks, cancellations, etc.)

LINE 10: Other: please attach a separate sheet of paper explaining other circumstances.

LINE 11: Total of your taxable receipts (line 6 minus 7, 8, 9,10)

LINE 12: Tax due equals 7% of line 11 (line 11 x .07)

LINE 13: Vendor’s allowance (line 11 x .0015 – max of $1,000); you must file and pay on time to receive the

allowance, allowance only applies to 3% of taxable receipts.

LINE 14: Total tax due (line 12 minus line 13)

LINE 15: Amount paid with this return

Make check payable to the Department of Revenue and mail with this coupon to:

Department of Revenue, PO Box 5835, Helena, MT 59604-5835

------------------------------------------------------

----------------------------------------------------------

Cut on this line

Montana Department of Revenue

Above space is for department use only.

Lodging Facility Sales and Use Tax

1. FEIN

2. Account ID

6. Gross receipts

3. Quarter Ending

If this is an amended return,

Due:

check here

7. Less: 30 day continuous rentals

(

)

4. If you are no longer in business and want your account

8. Less: federal employee exemption

(

)

cancelled, enter the final date.

5. Give monthly breakdown of gross receipts

9. Less: uncollectible charges

(

)

Month 1_____________

Month 2_____________

Month 3 ______________

10. Other (attach explanation)

(

)

11. Taxable Receipts

Signature

(line 6 minus lines 7-10)

(

)

Title

12. Tax (7% of line 11)

Phone

Date

13. Less: vendor allowance

(see instructions)

(

)

Name ________________________________________

Address ______________________________________

14. Total tax due (line 12 minus line 13)

15. Amount paid with

cents

Address ______________________________________

this return

,

.

,

City, State Zip _________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1