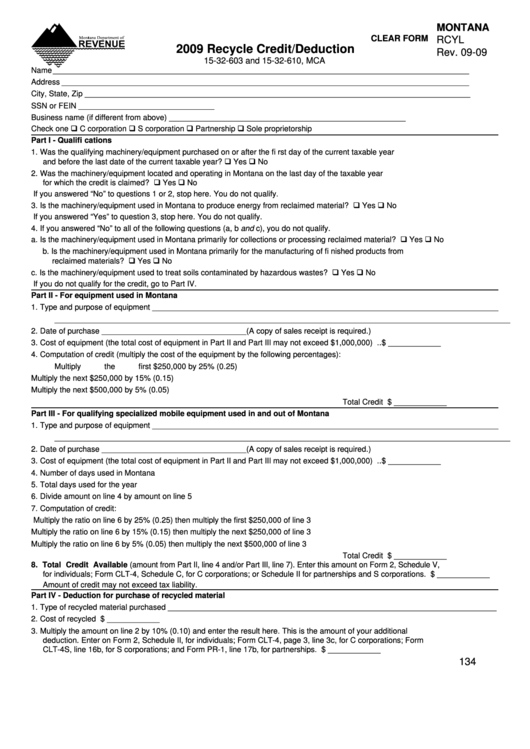

MONTANA

CLEAR FORM

RCYL

2009 Recycle Credit/Deduction

Rev. 09-09

15-32-603 and 15-32-610, MCA

Name _______________________________________________________________________________________________

Address _____________________________________________________________________________________________

City, State, Zip ________________________________________________________________________________________

SSN or FEIN _______________________________

Business name (if different from above) ______________________________________________________

C corporation

S corporation

Partnership

Sole proprietorship

Check one

Part I - Qualifi cations

1. Was the qualifying machinery/equipment purchased on or after the fi rst day of the current taxable year

No

and before the last date of the current taxable year?................................................................................................... Yes

2. Was the machinery/equipment located and operating in Montana on the last day of the taxable year

No

for which the credit is claimed? .................................................................................................................................... Yes

If you answered “No” to questions 1 or 2, stop here. You do not qualify.

No

3. Is the machinery/equipment used in Montana to produce energy from reclaimed material? ....................................... Yes

If you answered “Yes” to question 3, stop here. You do not qualify.

4. If you answered “No” to all of the following questions (a, b and c), you do not qualify.

No

a. Is the machinery/equipment used in Montana primarily for collections or processing reclaimed material? ............. Yes

b. Is the machinery/equipment used in Montana primarily for the manufacturing of fi nished products from

No

reclaimed materials? ................................................................................................................................................ Yes

No

c. Is the machinery/equipment used to treat soils contaminated by hazardous wastes? ............................................ Yes

If you do not qualify for the credit, go to Part IV.

Part II - For equipment used in Montana

1. Type and purpose of equipment _______________________________________________________________________________

________________________________________________________________________________________________________

2. Date of purchase _________________________________ (A copy of sales receipt is required.)

3. Cost of equipment (the total cost of equipment in Part II and Part III may not exceed $1,000,000) ............................$ ____________

4. Computation of credit (multiply the cost of the equipment by the following percentages):

Multiply the fi rst $250,000 by 25% (0.25) ..................................................................................

____________

Multiply the next $250,000 by 15% (0.15) .................................................................................

____________

Multiply the next $500,000 by 5% (0.05) ...................................................................................

____________

Total Credit ........................$ ____________

Part III - For qualifying specialized mobile equipment used in and out of Montana

1. Type and purpose of equipment _______________________________________________________________________________

________________________________________________________________________________________________________

2. Date of purchase _________________________________ (A copy of sales receipt is required.)

3. Cost of equipment (the total cost of equipment in Part II and Part III may not exceed $1,000,000) ............................$ ____________

4. Number of days used in Montana ......................................

_____________

5. Total days used for the year ...............................................

_____________

6. Divide amount on line 4 by amount on line 5 .....................

_____________

7. Computation of credit:

Multiply the ratio on line 6 by 25% (0.25) then multiply the fi rst $250,000 of line 3 ...................

____________

Multiply the ratio on line 6 by 15% (0.15) then multiply the next $250,000 of line 3 ..................

____________

Multiply the ratio on line 6 by 5% (0.05) then multiply the next $500,000 of line 3 ....................

____________

Total Credit ........................$ ____________

8. Total Credit Available (amount from Part II, line 4 and/or Part III, line 7). Enter this amount on Form 2, Schedule V,

for individuals; Form CLT-4, Schedule C, for C corporations; or Schedule II for partnerships and S corporations. .....$ ____________

Amount of credit may not exceed tax liability.

Part IV - Deduction for purchase of recycled material

1. Type of recycled material purchased ___________________________________________________________________________

2. Cost of recycled material..............................................................................................................................................$ ____________

3. Multiply the amount on line 2 by 10% (0.10) and enter the result here. This is the amount of your additional

deduction. Enter on Form 2, Schedule II, for individuals; Form CLT-4, page 3, line 3c, for C corporations; Form

CLT-4S, line 16b, for S corporations; and Form PR-1, line 17b, for partnerships. .......................................................$ ____________

134

1

1 2

2