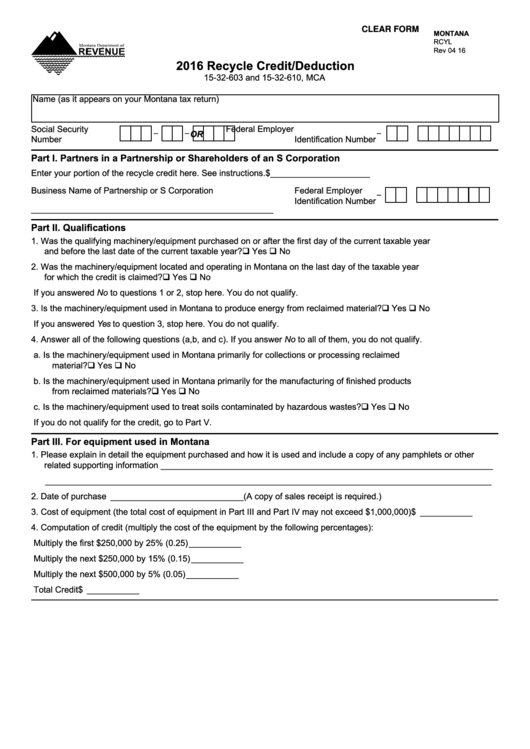

CLEAR FORM

MONTANA

RCYL

Rev 04 16

2016 Recycle Credit/Deduction

15-32-603 and 15-32-610, MCA

Name (as it appears on your Montana tax return)

Social Security

Federal Employer

-

-

-

OR

Number

Identification Number

Part I. Partners in a Partnership or Shareholders of an S Corporation

Enter your portion of the recycle credit here. See instructions.

$_____________________

Business Name of Partnership or S Corporation

Federal Employer

-

Identification Number

___________________________________________________

Part II. Qualifications

1. Was the qualifying machinery/equipment purchased on or after the first day of the current taxable year

and before the last date of the current taxable year? ............................................................................... Yes No

2. Was the machinery/equipment located and operating in Montana on the last day of the taxable year

for which the credit is claimed? ................................................................................................................. Yes No

If you answered No to questions 1 or 2, stop here. You do not qualify.

3. Is the machinery/equipment used in Montana to produce energy from reclaimed material? .................... Yes No

If you answered Yes to question 3, stop here. You do not qualify.

4. Answer all of the following questions (a,b, and c). If you answer No to all of them, you do not qualify.

a. Is the machinery/equipment used in Montana primarily for collections or processing reclaimed

material? ................................................................................................................................................ Yes No

b. Is the machinery/equipment used in Montana primarily for the manufacturing of finished products

from reclaimed materials? ..................................................................................................................... Yes No

c. Is the machinery/equipment used to treat soils contaminated by hazardous wastes? .......................... Yes No

If you do not qualify for the credit, go to Part V.

Part III. For equipment used in Montana

1. Please explain in detail the equipment purchased and how it is used and include a copy of any pamphlets or other

related supporting information ______________________________________________________________________

______________________________________________________________________________________________

2. Date of purchase ____________________________ (A copy of sales receipt is required.)

3. Cost of equipment (the total cost of equipment in Part III and Part IV may not exceed $1,000,000) ........ $ ___________

4. Computation of credit (multiply the cost of the equipment by the following percentages):

Multiply the first $250,000 by 25% (0.25) ...................................................................

___________

Multiply the next $250,000 by 15% (0.15) ..................................................................

___________

Multiply the next $500,000 by 5% (0.05) ....................................................................

___________

Total Credit .................... $ ___________

1

1 2

2 3

3