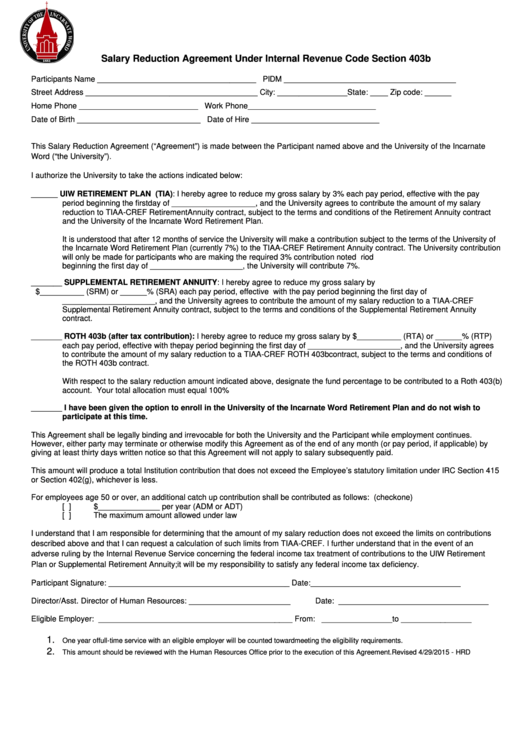

Salary Reduction Agreement Under Internal Revenue Code Section 403b Form

ADVERTISEMENT

Salary Reduction Agreement Under Internal Revenue Code Section 403b

Participants Name ____________________________________ PIDM _______________________________________

Street Address _______________________________________ City: ________________ State: ____ Zip code: ______

Home Phone ___________________________

Work Phone_____________________________

Date of Birth ____________________________

Date of Hire _____________________________

This Salary Reduction Agreement (“Agreement”) is made between the Participant named above and the University of the Incarnate

Word (“the University”).

I authorize the University to take the actions indicated below:

______ UIW RETIREMENT PLAN (TIA): I hereby agree to reduce my gross salary by 3% each pay period, effective with the pay

period beginning the first day of ___________________, and the University agrees to contribute the amount of my salary

reduction to TIAA-CREF Retirement Annuity contract, subject to the terms and conditions of the Retirement Annuity contract

and the University of the Incarnate Word Retirement Plan.

It is understood that after 12 months of service the University will make a contribution subject to the terms of the University of

the Incarnate Word Retirement Plan (currently 7%) to the TIAA-CREF Retirement Annuity contract. The University contribution

will only be made for participants who are making the required 3% contribution noted above. Effective with the pay period

beginning the first day of _____________________, the University will contribute 7%.

_______ SUPPLEMENTAL RETIREMENT ANNUITY: I hereby agree to reduce my gross salary by

$__________ (SRM) or ______% (SRA) each pay period, effective with the pay period beginning the first day of

_____________________, and the University agrees to contribute the amount of my salary reduction to a TIAA-CREF

Supplemental Retirement Annuity contract, subject to the terms and conditions of the Supplemental Retirement Annuity

contract.

_______ ROTH 403b (after tax contribution): I hereby agree to reduce my gross salary by $__________ (RTA) or ______% (RTP)

each pay period, effective with the pay period beginning the first day of _____________________, and the University agrees

to contribute the amount of my salary reduction to a TIAA-CREF ROTH 403b contract, subject to the terms and conditions of

the ROTH 403b contract.

With respect to the salary reduction amount indicated above, designate the fund percentage to be contributed to a Roth 403(b)

account. Your total allocation must equal 100%

_______ I have been given the option to enroll in the University of the Incarnate Word Retirement Plan and do not wish to

participate at this time.

This Agreement shall be legally binding and irrevocable for both the University and the Participant while employment continues.

However, either party may terminate or otherwise modify this Agreement as of the end of any month (or pay period, if applicable) by

giving at least thirty days written notice so that this Agreement will not apply to salary subsequently paid.

This amount will produce a total Institution contribution that does not exceed the Employee’s statutory limitation under IRC Section 415

or Section 402(g), whichever is less.

For employees age 50 or over, an additional catch up contribution shall be contributed as follows: (check one)

[ ]

$______________ per year (ADM or ADT)

[ ]

The maximum amount allowed under law

I understand that I am responsible for determining that the amount of my salary reduction does not exceed the limits on contributions

described above and that I can request a calculation of such limits from TIAA-CREF. I further understand that in the event of an

adverse ruling by the Internal Revenue Service concerning the federal income tax treatment of contributions to the UIW Retirement

Plan or Supplemental Retirement Annuity; it will be my responsibility to satisfy any federal income tax deficiency.

Participant Signature: _________________________________________

Date:

__________________________________

Director/Asst. Director of Human Resources: _______________________

Date:

__________________________________

Eligible Employer: ____________________________________________

From:

________________ to ________________

1.

One year of full-time service with an eligible employer will be counted toward meeting the eligibility requirements.

2.

This amount should be reviewed with the Human Resources Office prior to the execution of this Agreement.

Revised 4/29/2015 - HRD

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1