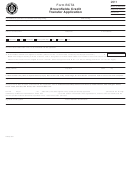

Form 336, Page 2

PART 2: BUSINESS OWNERS AND OPERATORS — CONTINUED

B. Concerning each business owner, officer, partner or member, answer all of the following questions:

1. Has an owner of the business:

Yes

No

(a) Been issued a tobacco tax license in another state in his/her own name or in the name

of a corporation, LLC, LLP or other entity? ...............................................................................................

If yes, list the name(s) of the state(s):

(b) Had a tobacco tax license/application suspended, revoked, refused or denied in Michigan

or in any other state? ................................................................................................................................

(c) Been charged with a crime (felony or misdemeanor)? ..............................................................................

2. If the business is a corporation, LLC, LLP or other entity, has an officer, shareholder, member or partner:

Yes

No

(a) Been issued a tobacco tax license in another state in his/her own name or in the name

of a corporation, LLC, LLP or other entity? ...............................................................................................

If yes, list the name(s) of the state(s):

(b) Had a tobacco tax license/application suspended, revoked, refused or denied in Michigan

or any other state? ....................................................................................................................................

(c) Been charged with a crime (felony or misdemeanor)? ..............................................................................

PART 3: BUSINESS OPERATIONS

List ALL companies from which you plan to purchase cigarettes (CIG), roll your own tobacco (RYO) or other tobacco products (OTP).

Attach additional sheets if necessary. NOTE: If importing tobacco from out of country, you must include a copy of your current

TTB Importers permit.

Tobacco Tax

Brand Family of CIG or RYO

Paid or

(You do not need to provide

Company Name, Address and Telephone Number

Tobacco Type

Unpaid?

the brand family of OTP.)

CIG

Paid

RYO

Unpaid

OTP

CIG

Paid

RYO

Unpaid

OTP

CIG

Paid

RYO

Unpaid

OTP

CIG

Paid

RYO

Unpaid

OTP

CIG

Paid

RYO

Unpaid

OTP

Note: If, during the license year, you purchase tobacco products from a company that is not listed above, you MUST provide

the Tobacco Tax Unit with all of the company information in Part 3.

1

1 2

2 3

3 4

4 5

5