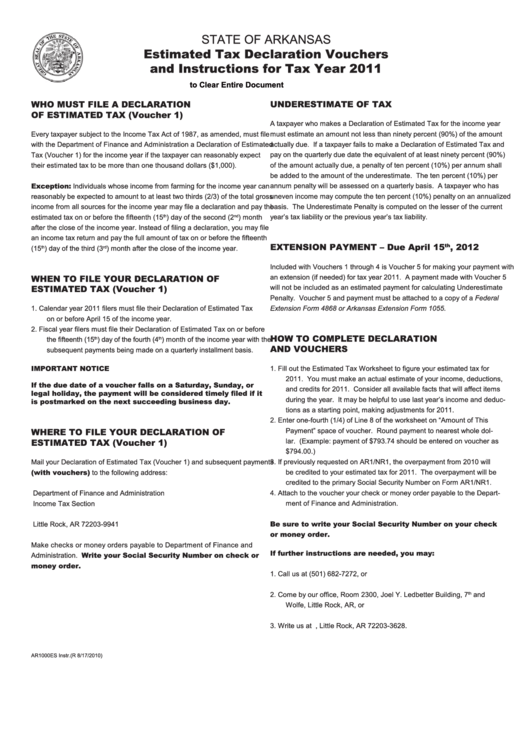

STATE OF ARKANSAS

Estimated Tax Declaration Vouchers

and Instructions for Tax Year 2011

Click Here to Clear Entire Document

WHO MUST FILE A DECLARATION

UNDERESTIMATE OF TAX

OF ESTIMATED TAX (Voucher 1)

A taxpayer who makes a Declaration of Estimated Tax for the income year

must estimate an amount not less than ninety percent (90%) of the amount

Every taxpayer subject to the Income Tax Act of 1987, as amended, must file

with the Department of Finance and Administration a Declaration of Estimated

actually due. If a taxpayer fails to make a Declaration of Estimated Tax and

Tax (Voucher 1) for the income year if the taxpayer can reasonably expect

pay on the quarterly due date the equivalent of at least ninety percent (90%)

their estimated tax to be more than one thousand dollars ($1,000).

of the amount actually due, a penalty of ten percent (10%) per annum shall

be added to the amount of the underestimate. The ten percent (10%) per

Exception: Individuals whose income from farming for the income year can

annum penalty will be assessed on a quarterly basis. A taxpayer who has

reasonably be expected to amount to at least two thirds (2/3) of the total gross

uneven income may compute the ten percent (10%) penalty on an annualized

income from all sources for the income year may file a declaration and pay the

basis. The Underestimate Penalty is computed on the lesser of the current

year’s tax liability or the previous year’s tax liability.

estimated tax on or before the fifteenth (15

) day of the second (2

) month

th

nd

after the close of the income year. Instead of filing a declaration, you may file

an income tax return and pay the full amount of tax on or before the fifteenth

EXTENSION PAYMENT – Due April 15

, 2012

th

(15

) day of the third (3

) month after the close of the income year.

th

rd

Included with Vouchers 1 through 4 is Voucher 5 for making your payment with

WHEN TO FILE YOUR DECLARATION OF

an extension (if needed) for tax year 2011. A payment made with Voucher 5

ESTIMATED TAX (Voucher 1)

will not be included as an estimated payment for calculating Underestimate

Penalty. Voucher 5 and payment must be attached to a copy of a Federal

1.

Calendar year 2011 filers must file their Declaration of Estimated Tax

Extension Form 4868 or Arkansas Extension Form 1055.

on or before April 15 of the income year.

2.

Fiscal year filers must file their Declaration of Estimated Tax on or before

HOW TO COMPLETE DECLARATION

the fifteenth (15

) day of the fourth (4

) month of the income year with the

th

th

AND VOUCHERS

subsequent payments being made on a quarterly installment basis.

IMPORTANT NOTICE

1.

Fill out the Estimated Tax Worksheet to figure your estimated tax for

2011. You must make an actual estimate of your income, deductions,

If the due date of a voucher falls on a Saturday, Sunday, or

and credits for 2011. Consider all available facts that will affect items

legal holiday, the payment will be considered timely filed if it

during the year. It may be helpful to use last year’s income and deduc-

is postmarked on the next succeeding business day.

tions as a starting point, making adjustments for 2011.

2.

Enter one-fourth (1/4) of Line 8 of the worksheet on “Amount of This

WHERE TO FILE YOUR DECLARATION OF

Payment” space of voucher. Round payment to nearest whole dol-

ESTIMATED TAX (Voucher 1)

lar. (Example: payment of $793.74 should be entered on voucher as

$794.00.)

3.

If previously requested on AR1/NR1, the overpayment from 2010 will

Mail your Declaration of Estimated Tax (Voucher 1) and subsequent payments

(with vouchers) to the following address:

be credited to your estimated tax for 2011. The overpayment will be

credited to the primary Social Security Number on Form AR1/NR1.

Department of Finance and Administration

4.

Attach to the voucher your check or money order payable to the Depart-

Income Tax Section

ment of Finance and Administration.

P.O. Box 9941

Be sure to write your Social Security Number on your check

Little Rock, AR 72203-9941

or money order.

Make checks or money orders payable to Department of Finance and

If further instructions are needed, you may:

Administration. Write your Social Security Number on check or

money order.

1.

Call us at (501) 682-7272, or

2.

Come by our office, Room 2300, Joel Y. Ledbetter Building, 7

and

th

Wolfe, Little Rock, AR, or

3.

Write us at P.O. Box 3628, Little Rock, AR 72203-3628.

AR1000ES Instr. (R 8/17/2010)

1

1 2

2 3

3 4

4 5

5 6

6