2010 Wooster Individual Tax Return Form

ADVERTISEMENT

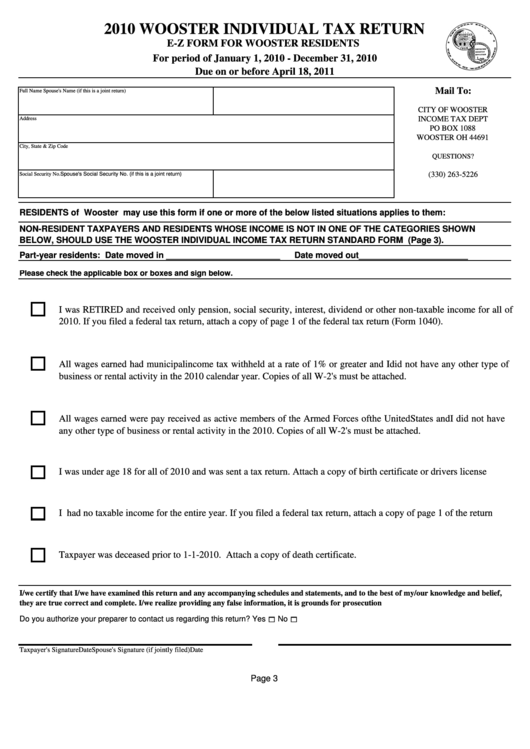

2010 WOOSTER INDIVIDUAL TAX RETURN

E-Z FORM FOR WOOSTER RESIDENTS

For period of January 1, 2010 - December 31, 2010

Due on or before April 18, 2011

Mail To:

Full Name

Spouse's Name (if this is a joint return)

CITY OF WOOSTER

INCOME TAX DEPT

Address

PO BOX 1088

WOOSTER OH 44691

City, State & Zip Code

QUESTIONS?

(330) 263-5226

Social Security No.

Spouse's Social Security No. (if this is a joint return)

RESIDENTS of Wooster may use this form if one or more of the below listed situations applies to them:

NON-RESIDENT TAXPAYERS AND RESIDENTS WHOSE INCOME IS NOT IN ONE OF THE CATEGORIES SHOWN

BELOW, SHOULD USE THE WOOSTER INDIVIDUAL INCOME TAX RETURN STANDARD FORM (Page 3).

Part-year residents: Date moved in ________________________

Date moved out_______________________

Please check the applicable box or boxes and sign below.

I was RETIRED and received only pension, social security, interest, dividend or other non-taxable income for all of

2010. If you filed a federal tax return, attach a copy of page 1 of the federal tax return (Form 1040).

All wages earned had municipal income tax withheld at a rate of 1% or greater and I did not have any other type of

business or rental activity in the 2010 calendar year. Copies of all W-2's must be attached.

All wages earned were pay received as active members of the Armed Forces of the United States and I did not have

any other type of business or rental activity in the 2010. Copies of all W-2's must be attached.

I was under age 18 for all of 2010 and was sent a tax return. Attach a copy of birth certificate or drivers license.

I had no taxable income for the entire year. If you filed a federal tax return, attach a copy of page 1 of the return.

Taxpayer was deceased prior to 1-1-2010. Attach a copy of death certificate.

I/we certify that I/we have examined this return and any accompanying schedules and statements, and to the best of my/our knowledge and belief,

they are true correct and complete. I/we realize providing any false information, it is grounds for prosecution

Do you authorize your preparer to contact us regarding this return? Yes

No

Taxpayer's Signature

Date

Spouse's Signature (if jointly filed)

Date

Page 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1