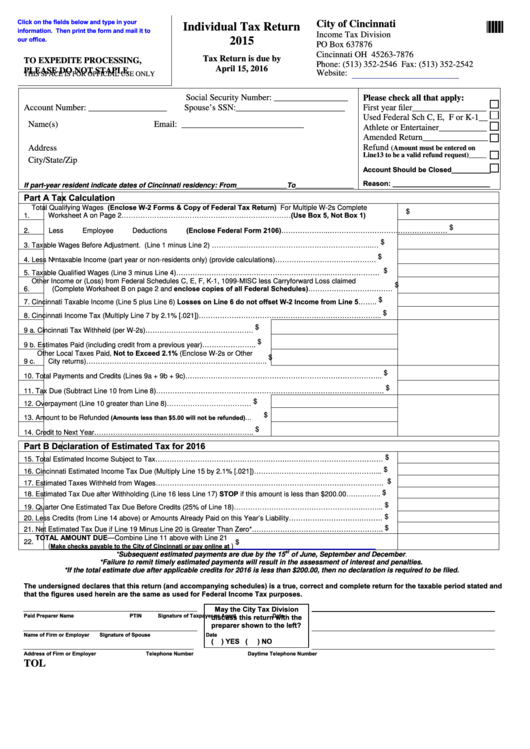

Click on the fields below and type in your

City of Cincinnati

11111

Individual Tax Return

information. Then print the form and mail it to

Income Tax Division

our office.

2015

PO Box 637876

Cincinnati OH 45263-7876

Tax Return is due by

TO EXPEDITE PROCESSING,

Phone: (513) 352-2546 Fax: (513) 352-2542

April 15, 2016

PLEASE DO NOT STAPLE

Website:

THIS SPACE IS FOR OFFICIAL USE ONLY

Social Security Number: _________________

Please check all that apply:

Account Number: __________________

Spouse’s SSN:_________________________

First year filer_________________

Used Federal Sch C, E, F or K-1__

Name(s)

Email: ____________________________

Athlete or Entertainer___________

Amended Return_______________

Refund

Address

(Amount must be entered on

Line13 to be a valid refund request)_____

City/State/Zip

Account Should be Closed__________

Reason: _________________________

If part-year resident indicate dates of Cincinnati residency: From_____________To_______________

Part A

Tax Calculation

Total Qualifying Wages (Enclose W-2 Forms & Copy of Federal Tax Return) For Multiple W-2s Complete

$

Worksheet A on Page 2………………………………………………………………(Use Box 5, Not Box 1)

1.

$

Less Employee Deductions (Enclose Federal Form 2106)………………..……………………………………………

2.

$

3.

Taxable Wages Before Adjustment. (Line 1 minus Line 2) …………..………………………………………..……..…

$

4.

Less Nontaxable Income (part year or non-residents only) (provide calculations)…………………………………….

$

5.

Taxable Qualified Wages (Line 3 minus Line 4)………………………………………………………...…………………

Other Income or (Loss) from Federal Schedules C, E, F, K-1, 1099-MISC less Carryforward Loss claimed

$

(Complete Worksheet B on page 2 and enclose copies of all Federal Schedules)………………………………

6.

$

Cincinnati Taxable Income (Line 5 plus Line 6) Losses on Line 6 do not offset W-2 Income from Line 5……..

7.

$

8.

Cincinnati Income Tax (Multiply Line 7 by 2.1% [.021])…………………………………………………………………...

$

9 a.

Cincinnati Tax Withheld (per W-2s)……………………………………….

$

9 b.

Estimates Paid (including credit from a previous year)…………………..

Other Local Taxes Paid, Not to Exceed 2.1% (Enclose W-2s or Other

$

9 c.

City returns)…………………………………………………………………..

$

10.

Total Payments and Credits (Lines 9a + 9b + 9c)…….…………………………………………………………………..

$

11.

Tax Due (Subtract Line 10 from Line 8)…………………………………………………………………………………….

$

12.

Overpayment (Line 10 greater than Line 8)………………………………

$

(Amounts less than $5.00 will not be refunded)…

13.

Amount to be Refunded

$

14.

Credit to Next Year…………………………………………………………..

Part B

Declaration of Estimated Tax for 2016

$

15.

Total Estimated Income Subject to Tax……………………………………………….……………………………………

$

16.

Cincinnati Estimated Income Tax Due (Multiply Line 15 by 2.1% [.021])……….……………………………………...

$

17.

Estimated Taxes Withheld from Wages…………………………………………………………………………………….

$

Estimated Tax Due after Withholding (Line 16 less Line 17) STOP if this amount is less than $200.00….………..

18.

$

19.

Quarter One Estimated Tax Due Before Credits (25% of Line 18)……………………………………………….……...

$

20.

Less Credits (from Line 14 above) or Amounts Already Paid on this Year’s Liability………………………….………

$

21.

Net Estimated Tax Due if Line 19 Minus Line 20 is Greater Than Zero*………………………………………………..

TOTAL AMOUNT DUE—Combine Line 11 above with Line 21

22.

$

Make checks payable to the City of Cincinnati or pay online at

(

)

st

*Subsequent estimated payments are due by the 15

of June, September and December.

*Failure to remit timely estimated payments will result in the assessment of interest and penalties.

*If the total estimate due after applicable credits for 2016 is less than $200.00, then no declaration is required to be filed.

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated and

that the figures used herein are the same as used for Federal Income Tax purposes.

May the City Tax Division

Paid Preparer Name

PTIN

Signature of Taxpayer or Agent

Date

discuss this return with the

preparer shown to the left?

Name of Firm or Employer

Signature of Spouse

Date

(

) YES

(

) NO

Address of Firm or Employer

Telephone Number

Daytime Telephone Number

TOL

1

1 2

2