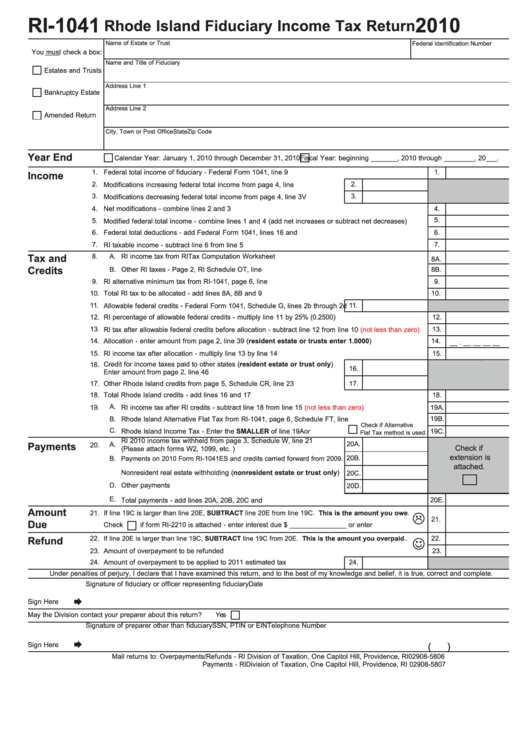

Form Ri-1041 - Rhode Island Fiduciary Income Tax Return - 2010

ADVERTISEMENT

RI-1041

2010

Rhode Island Fiduciary Income Tax Return

Name of Estate or Trust

Federal Identification Number

You must check a box:

Name and Title of Fiduciary

Estates and Trusts

Address Line 1

Bankruptcy Estate

Address Line 2

Amended Return

City, Town or Post Office

State

Zip Code

Year End

Calendar Year: January 1, 2010 through December 31, 2010

Fiscal Year: beginning _______, 2010 through ________, 20___.

1.

1.

Federal total income of fiduciary - Federal Form 1041, line 9 .........................................................................

Income

2.

Modifications increasing federal total income from page 4, line 2L ......................

2.

3.

3.

Modifications decreasing federal total income from page 4, line 3V ....................

4.

Net modifications - combine lines 2 and 3 ........................................................................................................

4.

5.

5.

Modified federal total income - combine lines 1 and 4 (add net increases or subtract net decreases) ...........

6.

Federal total deductions - add Federal Form 1041, lines 16 and 21.................................................................

6.

7.

7.

RI taxable income - subtract line 6 from line 5 .................................................................................................

Tax and

8.

A.

RI income tax from RI Tax Computation Worksheet ................................................................................

8A.

Credits

B.

Other RI taxes - Page 2, RI Schedule OT, line 51....................................................................................

8B.

9.

RI alternative minimum tax from RI-1041, page 6, line 6..................................................................................

9.

10.

Total RI tax to be allocated - add lines 8A, 8B and 9 .......................................................................................

10.

11.

Allowable federal credits - Federal Form 1041, Schedule G, lines 2b through 2d

11.

12.

12.

RI percentage of allowable federal credits - multiply line 11 by 25% (0.2500)..................................................

13.

RI tax after allowable federal credits before allocation - subtract line 12 from line 10

(not less than zero)

.....

13.

14.

Allocation - enter amount from page 2, line 39 (resident estate or trusts enter 1.0000) ..............................

14.

__ . __ __ __ __

15.

15.

RI income tax after allocation - multiply line 13 by line 14 ................................................................................

Credit for income taxes paid to other states (resident estate or trust only)

16.

16.

Enter amount from page 2, line 46 .......................................................................

17.

Other Rhode Island credits from page 5, Schedule CR, line 23 ..........................

17.

18.

Total Rhode Island credits - add lines 16 and 17 ..............................................................................................

18.

19.

A.

19A.

RI income tax after RI credits - subtract line 18 from line 15

(not less than zero)

..................................

B.

Rhode Island Alternative Flat Tax from RI-1041, page 6, Schedule FT, line 11.......................................

19B.

Check if Alternative

C.

Rhode Island Income Tax - Enter the SMALLER of line 19A or 19B............

19C.

Flat Tax method is used.

RI 2010 income tax withheld from page 3, Schedule W, line 21

20A.

A.

Payments

20.

Check if

(Please attach forms W2, 1099, etc. ) .......................................................

extension is

B.

Payments on 2010 Form RI-1041ES and credits carried forward from 2009.

20B.

attached.

C.

Nonresident real estate withholding (nonresident estate or trust only)....

20C.

D.

Other payments ...........................................................................................

20D.

E.

Total payments - add lines 20A, 20B, 20C and 20D................................................................................

20E.

Amount

21.

If line 19C is larger than line 20E, SUBTRACT line 20E from line 19C. This is the amount you owe.

21.

Due

Check

if form RI-2210 is attached - enter interest due $ _______________ or enter zero............

☺

22.

22.

If line 20E is larger than line 19C, SUBTRACT line 19C from 20E. This is the amount you overpaid..

Refund

23.

Amount of overpayment to be refunded ..................................................................................................

23.

24.

Amount of overpayment to be applied to 2011 estimated tax ..............................

24.

Under penalties of perjury, I declare that I have examined this return, and to the best of my knowledge and belief, it is true, correct and complete.

Signature of fiduciary or officer representing fiduciary

Date

Sign Here

May the Division contact your preparer about this return?

Yes

Signature of preparer other than fiduciary

SSN, PTIN or EIN

Telephone Number

Sign Here

(

)

Mail returns to: Overpayments/Refunds - RI Division of Taxation, One Capitol Hill, Providence, RI 02908-5806

Payments - RI Division of Taxation, One Capitol Hill, Providence, RI 02908-5807

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4