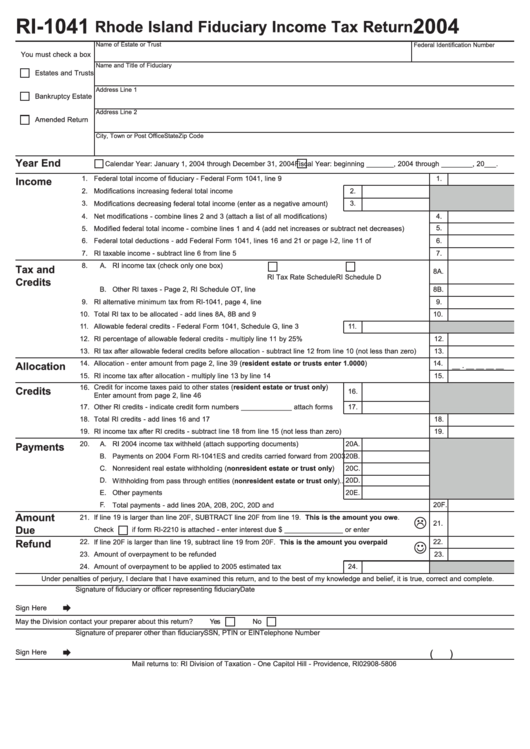

Form Ri-1041 - Rhode Island Fiduciary Income Tax Return - 2004

ADVERTISEMENT

RI-1041

2004

Rhode Island Fiduciary Income Tax Return

Name of Estate or Trust

Federal Identification Number

You must check a box

Name and Title of Fiduciary

Estates and Trusts

Address Line 1

Bankruptcy Estate

Address Line 2

Amended Return

City, Town or Post Office

State

Zip Code

Year End

Calendar Year: January 1, 2004 through December 31, 2004

Fiscal Year: beginning _______, 2004 through ________, 20___.

1.

1.

Federal total income of fiduciary - Federal Form 1041, line 9 ...........................................................................

Income

2.

Modifications increasing federal total income .........................................................

2.

3.

Modifications decreasing federal total income (enter as a negative amount) ........

3.

4.

Net modifications - combine lines 2 and 3 (attach a list of all modifications) ......................................................

4.

5.

5.

Modified federal total income - combine lines 1 and 4 (add net increases or subtract net decreases) .............

6.

Federal total deductions - add Federal Form 1041, lines 16 and 21 or page I-2, line 11 of instructions.............

6.

7.

RI taxable income - subtract line 6 from line 5 ....................................................................................................

7.

8.

A.

RI income tax (check only one box)

Tax and

8A.

RI Tax Rate Schedule

RI Schedule D

Credits

B.

Other RI taxes - Page 2, RI Schedule OT, line 51......................................................................................

8B.

9.

RI alternative minimum tax from RI-1041, page 4, line 14...................................................................................

9.

10.

Total RI tax to be allocated - add lines 8A, 8B and 9 .........................................................................................

10.

11.

Allowable federal credits - Federal Form 1041, Schedule G, line 3 .......................

11.

12.

RI percentage of allowable federal credits - multiply line 11 by 25% ..................................................................

12.

13.

RI tax after allowable federal credits before allocation - subtract line 12 from line 10 (not less than zero) .......

13.

14.

Allocation - enter amount from page 2, line 39 (resident estate or trusts enter 1.0000) ................................

14.

Allocation

__ . __ __ __ __

15.

RI income tax after allocation - multiply line 13 by line 14 ..................................................................................

15.

16.

Credit for income taxes paid to other states (resident estate or trust only)

Credits

16.

Enter amount from page 2, line 46 .........................................................................

17.

Other RI credits - indicate credit form numbers _____________ attach forms .....

17.

18.

18.

Total RI credits - add lines 16 and 17 ..................................................................................................................

19.

19.

RI income tax after RI credits - subtract line 18 from line 15 (not less than zero) ..............................................

20.

A.

20A.

RI 2004 income tax withheld (attach supporting documents)........................

Payments

B.

Payments on 2004 Form RI-1041ES and credits carried forward from 2003

20B.

C.

Nonresident real estate withholding (nonresident estate or trust only).....

20C.

D.

20D.

Withholding from pass through entities (nonresident estate or trust only)..

E.

Other payments .............................................................................................

20E.

F.

Total payments - add lines 20A, 20B, 20C, 20D and 20E..........................................................................

20F.

Amount

21.

If line 19 is larger than line 20F, SUBTRACT line 20F from line 19. This is the amount you owe. .....

21.

Due

Check

if form RI-2210 is attached - enter interest due $ _______________ or enter zero..............

Refund

22.

If line 20F is larger than line 19, subtract line 19 from 20F. This is the amount you overpaid.............

22.

☺

23.

Amount of overpayment to be refunded ....................................................................................................

23.

24.

Amount of overpayment to be applied to 2005 estimated tax ................................

24.

Under penalties of perjury, I declare that I have examined this return, and to the best of my knowledge and belief, it is true, correct and complete.

Signature of fiduciary or officer representing fiduciary

Date

Sign Here

May the Division contact your preparer about this return?

Yes

No

Signature of preparer other than fiduciary

SSN, PTIN or EIN

Telephone Number

Sign Here

(

)

Mail returns to: RI Division of Taxation - One Capitol Hill - Providence, RI 02908-5806

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4