Estimate Of Quarterly Tax Due Form - City Of Parma, Ohio - Division Of Taxation

ADVERTISEMENT

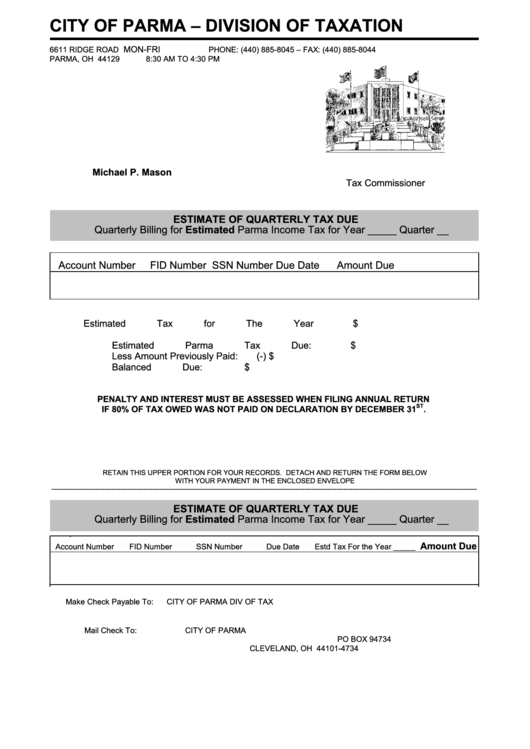

CITY OF PARMA – DIVISION OF TAXATION

MON-FRI

6611 RIDGE ROAD

PHONE: (440) 885-8045 – FAX: (440) 885-8044

PARMA, OH 44129

8:30 AM TO 4:30 PM

Michael P. Mason

Tax Commissioner

ESTIMATE OF QUARTERLY TAX DUE

Quarterly Billing for Estimated Parma Income Tax for Year _____ Quarter __

Account Number

FID Number

SSN Number

Due Date

Amount Due

Estimated Tax for The Year

$

Estimated Parma Tax Due:

$

Less Amount Previously Paid:

(-) $

Balanced Due:

$

PENALTY AND INTEREST MUST BE ASSESSED WHEN FILING ANNUAL RETURN

ST

IF 80% OF TAX OWED WAS NOT PAID ON DECLARATION BY DECEMBER 31

.

RETAIN THIS UPPER PORTION FOR YOUR RECORDS. DETACH AND RETURN THE FORM BELOW

WITH YOUR PAYMENT IN THE ENCLOSED ENVELOPE

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

ESTIMATE OF QUARTERLY TAX DUE

Quarterly Billing for Estimated Parma Income Tax for Year _____ Quarter __

.

Amount Due

Account Number

FID Number

SSN Number

Due Date

Estd Tax For the Year _____

Make Check Payable To:

CITY OF PARMA DIV OF TAX

Mail Check To:

CITY OF PARMA

PO BOX 94734

CLEVELAND, OH 44101-4734

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1