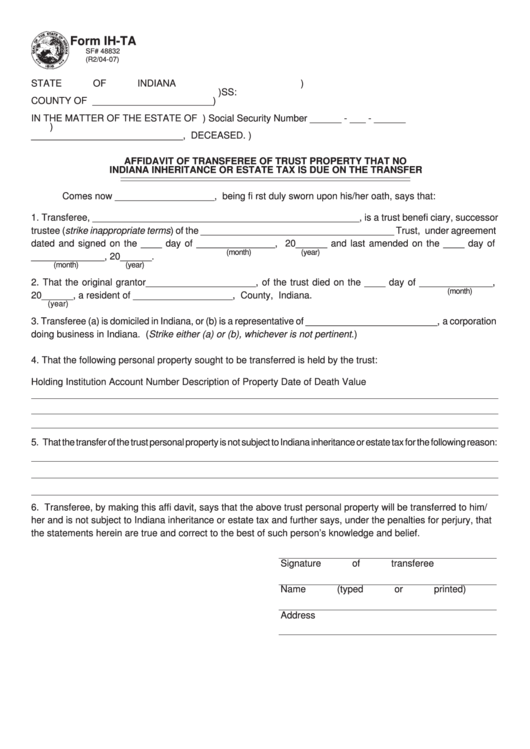

Form Ih-Ta - Affidavit Of Transferee Of Trust Property That No Indiana Inheritance Or Estate Tax Is Due On The Transfer - Indiana

ADVERTISEMENT

Form IH-TA

SF# 48832

(R2/04-07)

STATE OF INDIANA

)

)SS:

COUNTY OF _______________________ )

IN THE MATTER OF THE ESTATE OF

)

Social Security Number ______ - ___ - ______

)

_____________________________, DECEASED. )

AFFIDAVIT OF TRANSFEREE OF TRUST PROPERTY THAT NO

INDIANA INHERITANCE OR ESTATE TAX IS DUE ON THE TRANSFER

Comes now ___________________, being fi rst duly sworn upon his/her oath, says that:

1. Transferee, ___________________________________________________, is a trust benefi ciary, successor

trustee (strike inappropriate terms) of the _____________________________________ Trust, under agreement

dated and signed on the ____ day of _______________, 20______ and last amended on the ____ day of

(month)

(year)

______________, 20______.

(month)

(year)

2. That the original grantor_____________________, of the trust died on the ____ day of ______________,

(month)

20______, a resident of ___________________, County, Indiana.

(year)

3. Transferee (a) is domiciled in Indiana, or (b) is a representative of _________________________, a corporation

doing business in Indiana. (Strike either (a) or (b), whichever is not pertinent.)

4. That the following personal property sought to be transferred is held by the trust:

Holding Institution

Account Number

Description of Property

Date of Death Value

5. That the transfer of the trust personal property is not subject to Indiana inheritance or estate tax for the following reason:

6. Transferee, by making this affi davit, says that the above trust personal property will be transferred to him/

her and is not subject to Indiana inheritance or estate tax and further says, under the penalties for perjury, that

the statements herein are true and correct to the best of such person’s knowledge and belief.

Signature of transferee

Name (typed or printed)

Address

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2