PRINT

CLEAR

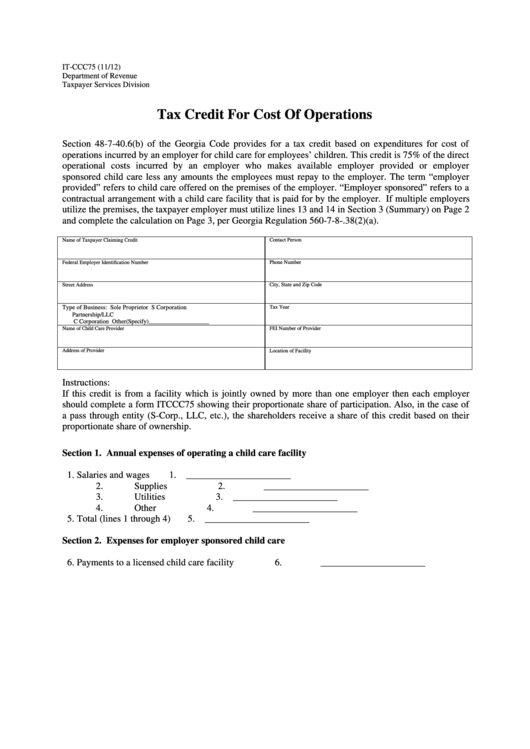

IT-CCC75 (1 1 /12)

Department of Revenue

Taxpayer Services Division

Tax Credit For Cost Of Operations

Section 48-7-40.6(b) of the Georgia Code provides for a tax credit based on expenditures for cost of

operations incurred by an employer for child care for employees’ children. This credit is 75% of the direct

operational costs incurred by an employer who makes available employer provided or employer

sponsored child care less any amounts the employees must repay to the employer. The term “employer

provided” refers to child care offered on the premises of the employer. “Employer sponsored” refers to a

contractual arrangement with a child care facility that is paid for by the employer. If multiple employers

utilize the premises, the taxpayer employer must utilize lines 13 and 14 in Section 3 (Summary) on Page 2

and complete the calculation on Page 3, per Georgia Regulation 560-7-8-.38(2)(a).

Name of Taxpayer Claiming Credit

Contact Person

Federal Employer Identification Number

Phone Number

Street Address

City, State and Zip Code

Type of Business:

Sole Proprietor

S Corporation

Tax Year

Partnership/LLC

C Corporation

Other(Specify)____________________

Name of Child Care Provider

FEI Number of Provider

Address of Provider

Location of Facility

Instructions:

If this credit is from a facility which is jointly owned by more than one employer then each employer

should complete a form ITCCC75 showing their proportionate share of participation. Also, in the case of

a pass through entity (S-Corp., LLC, etc.), the shareholders receive a share of this credit based on their

proportionate share of ownership.

Section 1. Annual expenses of operating a child care facility

1. Salaries and wages

1. ______________________

2. Supplies

2. ______________________

3. Utilities

3. ______________________

4. Other

4. ______________________

5. Total (lines 1 through 4)

5. ______________________

Section 2. Expenses for employer sponsored child care

6. Payments to a licensed child care facility

6. ______________________

1

1 2

2 3

3