CLEAR

PRINT

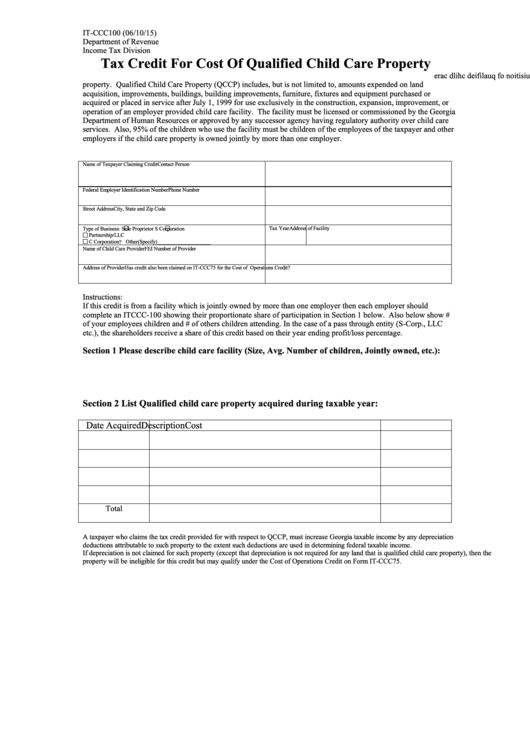

IT-CCC100 (06/10/15)

Department of Revenue

Income Tax Division

Tax Credit For Cost Of Qualified Child Care Property

e S

i t c

n o

8 4

7 -

4 -

. 0

( 6

) d

o

t f

e h

G

o e

g r

a i

C

o

e d

p

o r

i v

e d

f s

r o

t a

x a

c

e r

i d

b t

s a

d e

o

t n

e h

c a

u q

s i

i t i

n o

f o

u q

l a

i f i

d e

c

i h

d l

a c

e r

property. Qualified Child Care Property (QCCP) includes, but is not limited to, amounts expended on land

acquisition, improvements, buildings, building improvements, furniture, fixtures and equipment purchased or

acquired or placed in service after July 1, 1999 for use exclusively in the construction, expansion, improvement, or

operation of an employer provided child care facility. The facility must be licensed or commissioned by the Georgia

Department of Human Resources or approved by any successor agency having regulatory authority over child care

services. Also, 95% of the children who use the facility must be children of the employees of the taxpayer and other

employers if the child care property is owned jointly by more than one employer.

Name of Taxpayer Claiming Credit

Contact Person

Federal Employer Identification Number

Phone Number

Street Address

City, State and Zip Code

Type of Business:

Sole Proprietor

S Corporation

Tax Year

Address of Facility

Partnership/LLC

C Corporation ? Other(Specify)____________________

Name of Child Care Provider

FEI Number of Provider

Address of Provider

Has credit also been claimed on IT-CCC75 for the Cost of Operations Credit?

Instructions:

If this credit is from a facility which is jointly owned by more than one employer then each employer should

complete an ITCCC-100 showing their proportionate share of participation in Section 1 below. Also below show #

of your employees children and # of others children attending. In the case of a pass through entity (S-Corp., LLC

etc.), the shareholders receive a share of this credit based on their year ending profit/loss percentage.

Section 1 Please describe child care facility (Size, Avg. Number of children, Jointly owned, etc.):

Section 2 List Qualified child care property acquired during taxable year:

Date Acquired

Description

Cost

Total

A taxpayer who claims the tax credit provided for with respect to QCCP, must increase Georgia taxable income by any depreciation

deductions attributable to such property to the extent such deductions are used in determining federal taxable income.

If depreciation is not claimed for such property (except that depreciation is not required for any land that is qualified child care property), then the

property will be ineligible for this credit but may qualify under the Cost of Operations Credit on Form IT-CCC75.

1

1 2

2 3

3