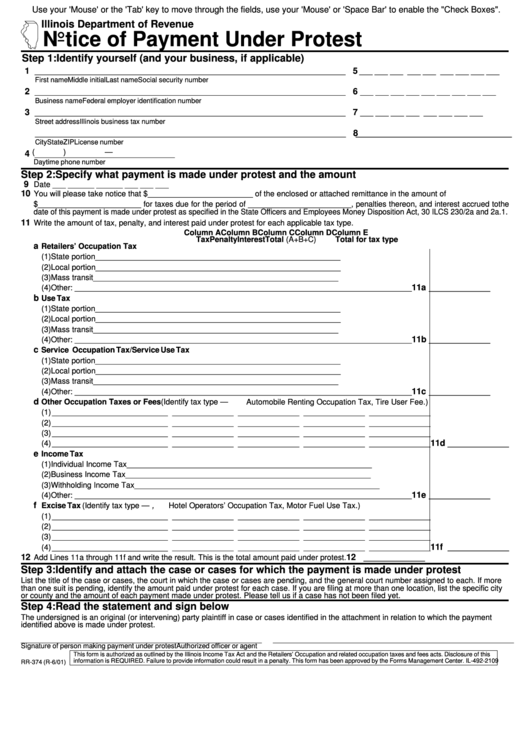

Use your 'Mouse' or the 'Tab' key to move through the fields, use your 'Mouse' or 'Space Bar' to enable the "Check Boxes".

Illinois Department of Revenue

Notice of Payment Under Protest

Step 1: Identify yourself (and your business, if applicable)

1

5

_______________________________________________________________________

___ ___ ___ ___ ___ ___ ___ ___ ___

First name

Middle initial

Last name

Social security number

2

6

_______________________________________________________________________

___ ___ ___ ___ ___ ___ ___ ___ ___

Business name

Federal employer identification number

3

7

_______________________________________________________________________

___ ___ ___ ___ ___ ___ ___ ___

Street address

Illinois business tax number

8

_______________________________________________________________________

____________________________________

City

State

ZIP

License number

(

)

—

4

________________________________

Daytime phone number

Step 2: Specify what payment is made under protest and the amount

9

Date ___ ______ ______ ___ ___ ___

10

You will please take notice that $________________________ of the enclosed or attached remittance in the amount of

$________________________ for taxes due for the period of ________________________, penalties thereon, and interest accrued to the

date of this payment is made under protest as specified in the State Officers and Employees Money Disposition Act, 30 ILCS 230/2a and 2a.1.

11

Write the amount of tax, penalty, and interest paid under protest for each applicable tax type.

Column A

Column B

Column C

Column D

Column E

Tax

Penalty

Interest

Total (A+B+C)

Total for tax type

a

Retailers’ Occupation Tax

(1) State portion

______________ ______________ ______________ ______________

(2) Local portion

______________ ______________ ______________ ______________

(3) Mass transit

______________ ______________ ______________ ______________

11a

(4) Other: _____________________ ______________ ______________ ______________ ______________

______________

b

Use Tax

(1) State portion

______________ ______________ ______________ ______________

(2) Local portion

______________ ______________ ______________ ______________

(3) Mass transit

______________ ______________ ______________ ______________

11b

(4) Other: _____________________ ______________ ______________ ______________ ______________

______________

c

Service Occupation Tax/Service Use Tax

(1) State portion

______________ ______________ ______________ ______________

(2) Local portion

______________ ______________ ______________ ______________

(3) Mass transit

______________ ______________ ______________ ______________

11c

(4) Other: _____________________ ______________ ______________ ______________ ______________

______________

d

Other Occupation Taxes or Fees (Identify tax type — e.g. Automobile Renting Occupation Tax, Tire User Fee.)

(1) ___________________________ ______________ ______________ ______________ ______________

(2) ___________________________ ______________ ______________ ______________ ______________

(3) ___________________________ ______________ ______________ ______________ ______________

11d

(4) ___________________________ ______________ ______________ ______________ ______________

______________

e

Income Tax

(1) Individual Income Tax

______________ ______________ ______________ ______________

(2) Business Income Tax

______________ ______________ ______________ ______________

(3) Withholding Income Tax

______________ ______________ ______________ ______________

11e

(4) Other: _____________________ ______________ ______________ ______________ ______________

______________

f

Excise Tax (Identify tax type — e.g., Hotel Operators’ Occupation Tax, Motor Fuel Use Tax.)

(1) ___________________________ ______________ ______________ ______________ ______________

(2) ___________________________ ______________ ______________ ______________ ______________

(3) ___________________________ ______________ ______________ ______________ ______________

11f

(4) ___________________________ ______________ ______________ ______________ ______________

______________

12

12

Add Lines 11a through 11f and write the result. This is the total amount paid under protest.

______________

Step 3: Identify and attach the case or cases for which the payment is made under protest

List the title of the case or cases, the court in which the case or cases are pending, and the general court number assigned to each. If more

than one suit is pending, identify the amount paid under protest for each case. If you are filing at more than one location, list the specific city

or county and the amount of each payment made under protest. Please tell us if a case has not been filed yet.

Step 4: Read the statement and sign below

The undersigned is an original (or intervening) party plaintiff in case or cases identified in the attachment in relation to which the payment

identified above is made under protest.

_______________________________________________________

_______________________________________________________

Signature of person making payment under protest

Authorized officer or agent

This form is authorized as outlined by the Illinois Income Tax Act and the Retailers’ Occupation and related occupation taxes and fees acts. Disclosure of this

information is REQUIRED. Failure to provide information could result in a penalty. This form has been approved by the Forms Management Center. IL-492-2109

RR-374 (R-6/01)

Reset

Print

1

1