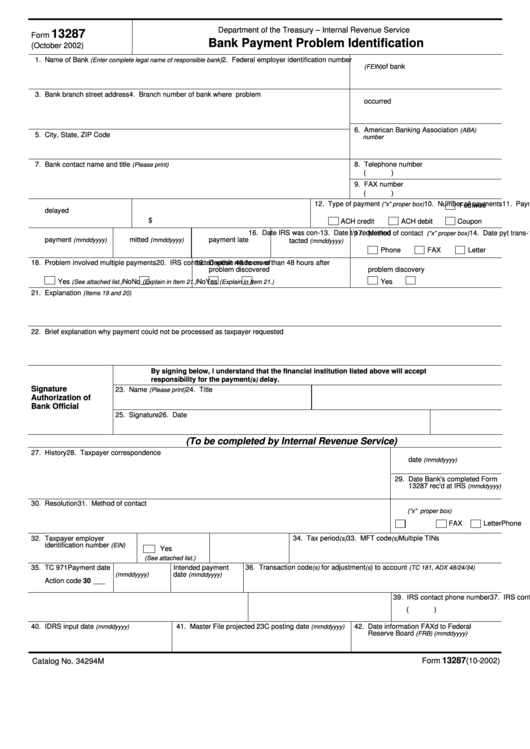

Department of the Treasury – Internal Revenue Service

13287

Form

Bank Payment Problem Identification

(October 2002)

1. Name of Bank

2. Federal employer identification number

(Enter complete legal name of responsible bank)

of bank

(FEIN)

3. Bank branch street address

4. Branch number of bank where problem

occurred

6. American Banking Association

(ABA)

5. City, State, ZIP Code

number

8. Telephone number

7. Bank contact name and title

(Please print)

(

)

9. FAX number

(

)

10. Number of payments

11. Payment / Combined payments amount

12. Type of payment

(“x” proper box)

Fed wire

delayed

$

ACH credit

ACH debit

Coupon

13. Date t/p requested

14. Date pyt trans-

15. Number of days

16. Date IRS was con-

17. Method of contact

(“x” proper box)

payment

mitted

payment late

(mmddyyyy)

(mmddyyyy)

tacted

(mmddyyyy)

Phone

FAX

Letter

18. Problem involved multiple payments

19. Deposit made more than 48 hours after

20. IRS contacted within 48 hours of

problem discovered

problem discovery

Yes

No

No

Yes

Yes

No

(See attached list.)

(Explain in Item 21.)

(Explain in Item 21.)

21. Explanation

(Items 19 and 20)

22. Brief explanation why payment could not be processed as taxpayer requested

By signing below, I understand that the financial institution listed above will accept

responsibility for the payment

delay.

(s)

Signature

23. Name

24. Title

(Please print)

Authorization of

Bank Official

25. Signature

26. Date

(To be completed by Internal Revenue Service)

27. History

28. Taxpayer correspondence

date

(mmddyyyy)

29. Date Bank's completed Form

13287 rec'd at IRS

(mmddyyyy)

30. Resolution

31. Method of contact

(“x” proper box)

Phone

FAX

Letter

32. Taxpayer employer

Multiple TINs

33. MFT code

34. Tax period

(s)

(s)

identification number

(EIN)

Yes

(See attached list.)

35. TC 971

Payment date

Intended payment

36. Transaction code

for adjustment

) to account

(s)

(s

(TC 181, ADX 48/24/34)

date

(mmddyyyy)

(mmddyyyy)

Action code 30

37. IRS contact name

38. IRS contact employee number

39. IRS contact phone number

(Please print)

(

)

40. IDRS input date

41. Master File projected 23C posting date

42. Date information FAXd to Federal

(mmddyyyy)

(mmddyyyy)

Reserve Board

(FRB) (mmddyyyy)

13287

Catalog No. 34294M

Form

(10-2002)

1

1