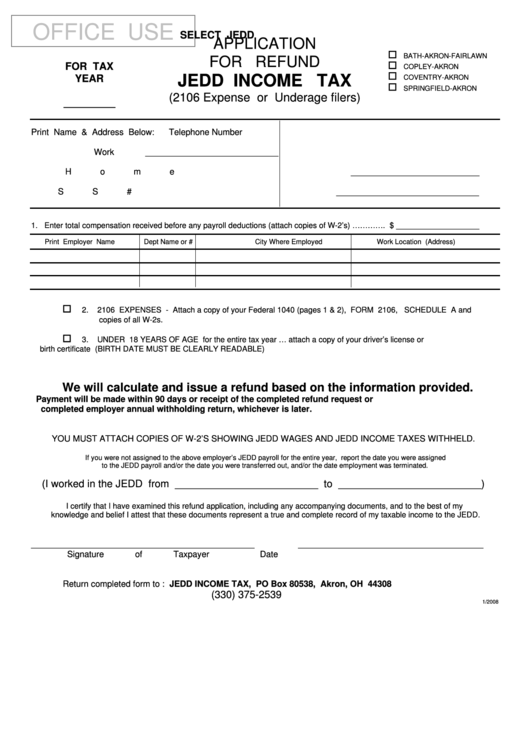

OFFICE USE

SELECT JEDD

APPLICATION

BATH-AKRON-FAIRLAWN

FOR REFUND

FOR TAX

COPLEY-AKRON

JEDD INCOME TAX

YEAR

COVENTRY-AKRON

SPRINGFIELD-AKRON

(2106 Expense or Underage filers)

_________

Print Name & Address Below:

Telephone Number

Work ____________________________

Home ___________________________

SS# ______________________________

1. Enter total compensation received before any payroll deductions (attach copies of W-2’s) …………. $ ___________________

Print Employer Name

Dept Name or #

City Where Employed

Work Location (Address)

2.

2106 EXPENSES - Attach a copy of your Federal 1040 (pages 1 & 2), FORM 2106, SCHEDULE A and

copies of all W-2s.

3.

UNDER 18 YEARS OF AGE for the entire tax year … attach a copy of your driver’s license or

birth certificate (BIRTH DATE MUST BE CLEARLY READABLE)

We will calculate and issue a refund based on the information provided.

Payment will be made within 90 days or receipt of the completed refund request or

completed employer annual withholding return, whichever is later.

YOU MUST ATTACH COPIES OF W-2’S SHOWING JEDD WAGES AND JEDD INCOME TAXES WITHHELD.

If you were not assigned to the above employer’s JEDD payroll for the entire year, report the date you were assigned

to the JEDD payroll and/or the date you were transferred out, and/or the date employment was terminated.

(I worked in the JEDD from _________________________ to _________________________)

I certify that I have examined this refund application, including any accompanying documents, and to the best of my

knowledge and belief I attest that these documents represent a true and complete record of my taxable income to the JEDD.

_______________________________________________

_______________________________________

Signature of Taxpayer

Date

Return completed form to : JEDD INCOME TAX, PO Box 80538, Akron, OH 44308

(330) 375-2539

1/2008

1

1