Application For Refund Form- Income Tax Department - City Of Euclid

ADVERTISEMENT

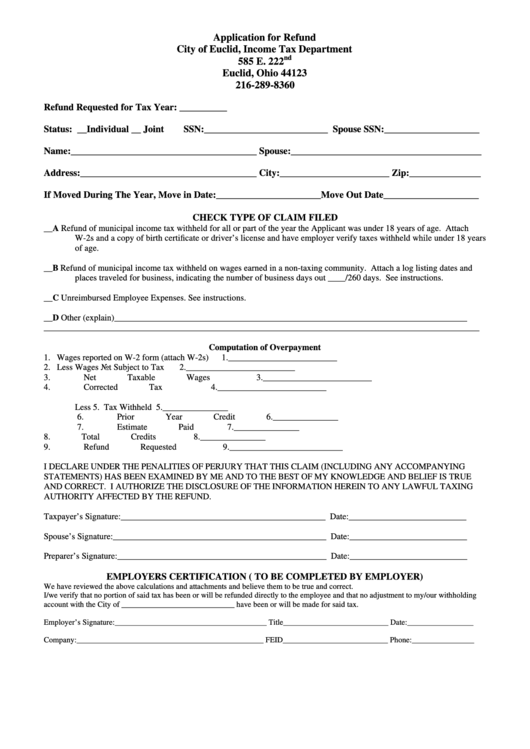

Application for Refund

City of Euclid, Income Tax Department

nd

585 E. 222

Euclid, Ohio 44123

216-289-8360

Refund Requested for Tax Year: __________

Status: __Individual __ Joint

SSN:__________________________ Spouse SSN:____________________

Name:_______________________________________ Spouse:________________________________________

Address:_____________________________________ City:_______________________ Zip:_______________

If Moved During The Year, Move in Date:______________________Move Out Date____________________

CHECK TYPE OF CLAIM FILED

__A

Refund of municipal income tax withheld for all or part of the year the Applicant was under 18 years of age. Attach

W-2s and a copy of birth certificate or driver’s license and have employer verify taxes withheld while under 18 years

of age.

__B

Refund of municipal income tax withheld on wages earned in a non-taxing community. Attach a log listing dates and

places traveled for business, indicating the number of business days out ____/260 days. See instructions.

__C

Unreimbursed Employee Expenses. See instructions.

__D

Other (explain)_________________________________________________________________________________

____________________________________________________________________________________________________

Computation of Overpayment

1. Wages reported on W-2 form (attach W-2s)

1._________________________

2. Less Wages Not Subject to Tax

2._________________________

3. Net Taxable Wages

3._________________________

4. Corrected Tax

4._________________________

Less

5. Tax Withheld

5._______________

6. Prior Year Credit

6._______________

7. Estimate Paid

7._______________

8. Total Credits

8._______________

9. Refund Requested

9.__________________________

I DECLARE UNDER THE PENALITIES OF PERJURY THAT THIS CLAIM (INCLUDING ANY ACCOMPANYING

STATEMENTS) HAS BEEN EXAMINED BY ME AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IS TRUE

AND CORRECT. I AUTHORIZE THE DISCLOSURE OF THE INFORMATION HEREIN TO ANY LAWFUL TAXING

AUTHORITY AFFECTED BY THE REFUND.

Taxpayer’s Signature:_______________________________________________ Date:___________________________

Spouse’s Signature:_________________________________________________ Date:___________________________

Preparer’s Signature:________________________________________________ Date:___________________________

EMPLOYERS CERTIFICATION ( TO BE COMPLETED BY EMPLOYER)

We have reviewed the above calculations and attachments and believe them to be true and correct.

I/we verify that no portion of said tax has been or will be refunded directly to the employee and that no adjustment to my/our withholding

account with the City of _____________________________ have been or will be made for said tax.

Employer’s Signature:_______________________________________ Title___________________________ Date:_________________

Company:________________________________________________ FEID___________________________ Phone:________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2