Form Pit-Cg - New Mexico Caregiver'S Statement - 2010

ADVERTISEMENT

REV. 12/2010

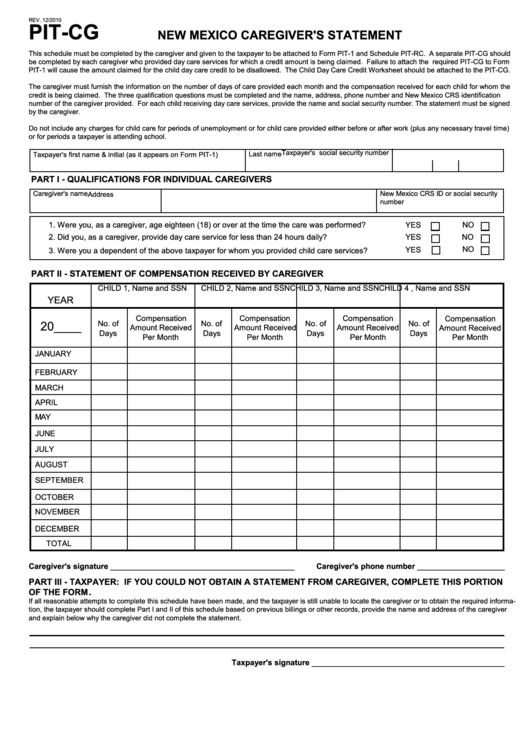

PIT-CG

NEW MEXICO CAREGIVER'S STATEMENT

This schedule must be completed by the caregiver and given to the taxpayer to be attached to Form PIT-1 and Schedule PIT-RC. A separate PIT-CG should

be completed by each caregiver who provided day care services for which a credit amount is being claimed. Failure to attach the required PIT-CG to Form

PIT-1 will cause the amount claimed for the child day care credit to be disallowed. The Child Day Care Credit Worksheet should be attached to the PIT-CG.

The caregiver must furnish the information on the number of days of care provided each month and the compensation received for each child for whom the

credit is being claimed. The three qualification questions must be completed and the name, address, phone number and New Mexico CRS identification

number of the caregiver provided. For each child receiving day care services, provide the name and social security number. The statement must be signed

by the caregiver.

Do not include any charges for child care for periods of unemployment or for child care provided either before or after work (plus any necessary travel time)

or for periods a taxpayer is attending school.

Taxpayer's social security number

Last name

Taxpayer's first name & initial (as it appears on Form PIT-1)

PART I - QUALIFICATIONS FOR INDIVIDUAL CAREGIVERS

Caregiver's name

New Mexico CRS ID or social security

Address

number

1. Were you, as a caregiver, age eighteen (18) or over at the time the care was performed?

NO

YES

2. Did you, as a caregiver, provide day care service for less than 24 hours daily?

YES

NO

NO

YES

3. Were you a dependent of the above taxpayer for whom you provided child care services?

PART II - STATEMENT OF COMPENSATION RECEIVED BY CAREGIVER

CHILD 1, Name and SSN

CHILD 2, Name and SSN

CHILD 3, Name and SSN

CHILD 4 , Name and SSN

YEAR

Compensation

Compensation

Compensation

Compensation

20____

No. of

No. of

No. of

No. of

Amount Received

Amount Received

Amount Received

Amount Received

Days

Days

Days

Days

Per Month

Per Month

Per Month

Per Month

JANUARY

FEBRUARY

MARCH

APRIL

MAY

JUNE

JULY

AUGUST

SEPTEMBER

OCTOBER

NOVEMBER

DECEMBER

TOTAL

Caregiver's signature __________________________________________

Caregiver's phone number ____________________

PART III - TAXPAYER: IF YOU COULD NOT OBTAIN A STATEMENT FROM CAREGIVER, COMPLETE THIS PORTION

OF THE FORM.

If all reasonable attempts to complete this schedule have been made, and the taxpayer is still unable to locate the caregiver or to obtain the required informa-

tion, the taxpayer should complete Part I and II of this schedule based on previous billings or other records, provide the name and address of the caregiver

and explain below why the caregiver did not complete the statement.

Taxpayer's signature ____________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2