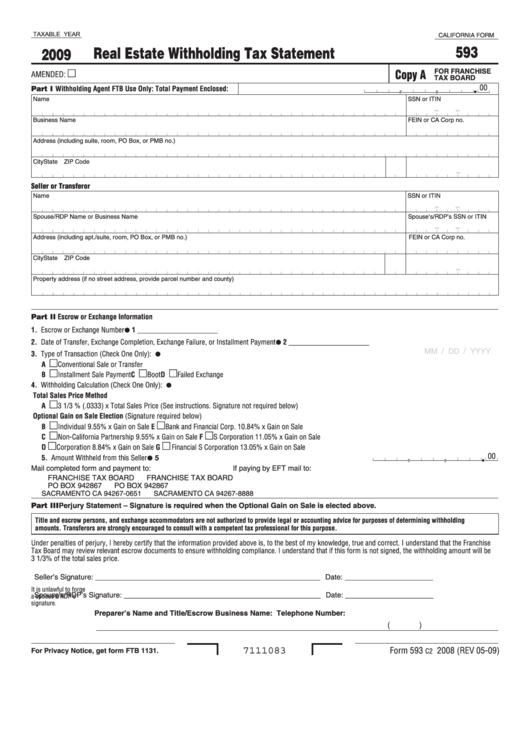

TAXABLE YEAR

CALIFORNIA FORM

593

Real Estate Withholding Tax Statement

2009

m

Copy A

FOR FRANCHISE

AMENDED:

TAX BOARD

.

00

Part I Withholding Agent

,

,

FTB Use Only: Total Payment Enclosed:

Name

SSN or ITIN

- -

Business Name

FEIN or CA Corp no .

Address (including suite, room, PO Box, or PMB no .)

City

State ZIP Code

-

Seller or Transferor

Name

SSN or ITIN

- -

Spouse/RDP Name or Business Name

Spouse’s/RDP’s SSN or ITIN

- -

Address (including apt ./suite, room, PO Box, or PMB no .)

FEIN or CA Corp no .

City

State

ZIP Code

-

Property address (if no street address, provide parcel number and county)

Part II Escrow or Exchange Information

I

1. Escrow or Exchange Number . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 ____________________

I

2. Date of Transfer, Exchange Completion, Exchange Failure, or Installment Payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 ____________________

I

/

/

MM

DD

YYYY

3. Type of Transaction (Check One Only):

m

A

Conventional Sale or Transfer

m

m

m

B

Installment Sale Payment

C

Boot

D

Failed Exchange

I

4. Withholding Calculation (Check One Only):

Total Sales Price Method

m

A

3 1/3 % (.0333) x Total Sales Price (See instructions. Signature not required below)

Optional Gain on Sale Election (Signature required below)

m

m

B

Individual 9.55% x Gain on Sale

E

Bank and Financial Corp. 10.84% x Gain on Sale

m

m

C

Non-California Partnership 9.55% x Gain on Sale

F

S Corporation 11.05% x Gain on Sale

m

m

D

Corporation 8.84% x Gain on Sale

G

Financial S Corporation 13.05% x Gain on Sale

I

.

00

,

,

5. Amount Withheld from this Seller . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

Mail completed form and payment to:

If paying by EFT mail to:

FRANCHISE TAX BOARD

FRANCHISE TAX BOARD

PO BOX 942867

PO BOX 942867

SACRAMENTO CA 94267-0651

SACRAMENTO CA 94267-8888

Part III Perjury Statement – Signature is required when the Optional Gain on Sale is elected above.

Title and escrow persons, and exchange accommodators are not authorized to provide legal or accounting advice for purposes of determining withholding

amounts. Transferors are strongly encouraged to consult with a competent tax professional for this purpose.

Under penalties of perjury, I hereby certify that the information provided above is, to the best of my knowledge, true and correct. I understand that the Franchise

Tax Board may review relevant escrow documents to ensure withholding compliance. I understand that if this form is not signed, the withholding amount will be

3 1/3% of the total sales price.

Seller’s Signature: _ _______________________________________________________ Date: ______________________

It is unlawful to forge

Spouse’s/RDP’s Signature: _ ________________________________________________ Date: ______________________

a spouse’s/RDP’s

signature.

Preparer’s Name and Title/Escrow Business Name:

Telephone Number:

(

)

Form 593

2008 (REV 05-09)

7111083

For Privacy Notice, get form FTB 1131.

C2

1

1 2

2 3

3