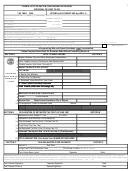

Taxpayer Information:

Phone #

please print or type

YOUR Soc Sec # or FEID#

Spouse Soc Sec #

if you have moved-give date

NAME:

moved in

SPOUSE:

moved out

ADDRESS:

if retired - give date

yours

spouse

FOR TAX YEAR ______________

(Due April 30th)

IF Fiscal Year

from __________________

through __________________

(Due 4 months after year end)

(start date: mmddyy)

(end date: mmddyy)

NORTON CITY INCOME TAX FORM

Summit County, Ohio District 7711

MAIL TO:

City of Norton Division of Taxation

4060 Columbia Woods Drive

phone: 330-825-4511

Norton OH 44203

web site:

Attach ALL W-2s, 1099s, Federal Schedules, Other City Returns, (Partial Year Resident - copy of page 1 of Federal Return)

INCOME SECTION

Include all deferred income.

1. Total Gross Wages from Salaries, Tips & Other Compensation

(use highest gross figure )

$

(DO NOT INCLUDE

Dividends or Interest.)

2. Other Taxable Income:

Include all Federal Schedules.

A. From: Self-Employment (attach Federal Schedule C, E, F or K-1's)

$

Partnerships (attach Federal Schedule 1065,)

$

Corporations (attach Federal Schedule 1120, 1120S, 1120A)

$

B. Rental and/or Leases (attach Federal Schedule E)

$

C. Total Other Taxable Income

(a LOSS cannot be deducted from Line 1)

$

3. Deduct Non Taxable Income

(from Page 2 Section C)

$

4. Total Taxable Income

(add Line 1, Plus Line C, Less Line 3)

$

5. Total Taxes Due Before Credit(s)

(Norton tax rate of 1.5% (.015) times Line 4)

$

CREDIT SECTION

6. A. Total Income Tax Withheld

$

(Maximum credit cannot exceed 1.5% (.015) of Gross Wages that have been fully withheld on.)

B. Overpayment from prior year, if not previously used.

$

C. Actual Estimated Tax Payments paid to the City of Norton.

$

D. Tax Returns(s)

FILED with Other Cities

(Maximum credit 1.5%)

$

Copy of the Return(s)

MUST

be included with this return to receive the credit.

E. TOTAL CREDITS (Add Lines 6A, B, C, D)

$

NET AMOUNT OF TAX DUE

7.

(Subtract Line 6E from Line 5)

$

8. A. Penalty $

Interest $

(Page 2 Section D)

$

B. Late Filing Penalty -

returns filed or postmarked after April 30th - add $15.00 Fee.

$

$

9.

BALANCE of TAX DUE

(Line 7 plus 8A and 8B)

Payment in full

MUST ACCOMPANY THIS RETURN.

Refund $

Credit $

10. OVERPAYMENT

OR

to next year's Estimate

NOTE:

NO Taxes or Refunds of $1.00 or less shall be collected or refunded.

To avoid interest & penalty IF you owed a tax liability for this year of $50.00 or more - It is MANDATORY that you file a Declaration of Estimated Tax for the next Tax Year

1. Total ESTIMATED income subject to Norton tax

$

2. Norton Tax @ 1.5%

$

3. Less taxes to be withheld by:

A. NORTON employer

$

B. By an employer in ___________________________________ $

(name of city & not to exceed 1.5% of the gross)

4. BALANCE ESTIMATED NORTON TAX (subtract 3A & 3B from #2)

$

5. Less Credits: A. Overpayment on previous year's return

$

B. Previous payments if this is a amended declaration

$

C. Other credits (specify)

$

TOTAL CREDITS

$

6. NET ESTIMATED TAX DUE (Line 4 less total of Line 5)

$

7.

Amount of Estimated Tax PAID with this return

(MUST

be at least 1/4 of Line 6)

$

1st quarter due April 30th - 2nd quarter due June 30th - 3rd quarter due September 30th - 4th quarter due January 31st

TOTAL TAX DUE - ADD LINES 9 AND 7

$

(REMIT THIS AMOUNT ON OR BEFORE APRIL 30TH.

I certify I have examined this return including accompanying schedules and statements, and to the best of my knowledge and belief, it is true and correct.

Signature of Person Preparing, if Other than Taxpayer

Date

Signature of Taxpayer or Agent (Required)

Date

Name and Address of Firm or Employer

Phone (

)

Signature of spouse, if joint return.

Date

page 2

revised 12/19/2002

1

1 2

2 3

3