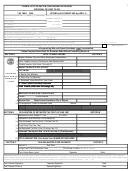

**************DISREGARD THE NEXT SECTIONS IF YOUR ENTIRE TAXABLE INCOME IS FROM SALARY AND WAGES**************

Attach ALL appropriate federal schedules or income statements for income from:

Partnerships,

SECTION A

Business, Farm Income, Estates, Trusts, Fees & Other(s).

Received From

For (Describe)

Federal Form(s) Attached

Amount

Total Business Income

Enter Schedule Z Line 1

$

(If Schedule X, Y, or Z is not applicable - Total to page 1, line 2A)

SECTION B

Information Regarding Rental Income From Federal Schedule E and R

1. Losses for rental units located and taxed outside the City cannot be used to offset income from rental units located inside the City of Norton.

2. Attach copy(ies) of the Federal Schedules or other Rental Income Statements and other City Tax Returns to this return.

SECTION C

Information Regarding Employee Business Expense, Partial Year Earnings, ETC.

1. 2106 Deductions: Norton recognizes this deduction only when the expense incurred applies to gross earnings that are in the

jurisdiction of the City of Norton.

2. Example of Norton Jurisdiction: If your City Income Tax Withheld was paid to the City of Norton by your employer, or if the City Tax

on your earnings is due to be paid to the City of Norton.

3. Attach copy(ies) of Federal Schedules 2106 and Schedule A, for "Employee Business Expense Deduction".

4. If Getting a Refund on a 2106 Deduction in another City; a copy of that City's Tax Return must be enclosed.

SECTION D

Information Regarding Penalties & Interest

Penalty is due at the rate of 1.5% (.015) per month or fraction thereof times the unpaid tax.

a

Interest is due at the rate of .5% (.005) per month or fraction thereof times the unpaid tax.

a

Penalty and Interest is due at above stated rates on unpaid tax even when extensions are granted.

a

SCHEDULE X

RECONCILIATION WITH FEDERAL INCOME TAX RETURN

Items Not Deductible

ADD

Items Not Taxable

DEDUCT

a. Capital Losses

(Excluding Ordinary Losses)

$

n. Capital Gains

b. Expenses incurred in the production of

$

(Excluding Ordinary Gains)

non-taxable income (at least 5% of Line Z)

$

c. Taxes paid to state and Local Municipalities

$

o. Interest Income $

d. Net Operating loss deduction per Federal Return

$

p. Dividends

$

e. Payments to partners

$

q. Other (explain)

f. Sick Pay not included in Line 1 above

$

g. Contributions

$

h. Other expenses not deductible

$

z. Total (Enter

$

(Explain)

on Schedule Z Line 2B)

m. Total (Enter on Schedule Z Line 2A)……

$

SCHEDULE Y

Use only if net profit from Norton Branch is not Available

Business Allocation Formula

a Located Everywhere

b Located In Norton

c Percentage (a + b)

STEP

1. Average Value of Real

& Tang Personal Property.

STEP

2. Gross Receipts from Sales Made

and/or Work or Services Performed

%

STEP

3. Wages, Salaries and Other

Compensation Paid Employees

%

4. Total Percentages

%

5. Average Percentage (Divide Total Percentages by Number of Percentages Used).

Enter on below Schedule Z Line 3B

%

Business Loss Carry Forward.

(Loss carried forward Maximum of 5 years and use only against Business Income)

Tax Year

(Loss CANNOT be used against W2s.)

1.

LOSS

$

2.

LOSS

$

3.

LOSS

$

4.

LOSS

$

5.

LOSS…………….

Profit (circle one)…………

$

6.

NET PROFIT OR LOSS (Carry to Tax Return Page 1 Line 2A or 2B)

$

SCHEDULE Z

1.

TOTAL BUSINESS INCOME

$

2.

A. Items NOT DEDUCTIBLE (Above Schedule X, Line M)

Add $

B. Items NOT TAXABLE (Above Schedule X, Line Z)

Deduct $

C. Enter EXCESS (Line 2A or 2B)

$

3.

A. Adjust NET INCOME (Line 1 Plus/Minus Line 2C) If Schedule X is Used

$

B. Amount Allocable to NORTON IF SCHEDULE Y STEP 5 is used.

% Of Line 3A $

4.

Taxable Business Income: FROM LINE 3A OR LINE 3B (Enter on Tax Return Page 1, Line 2A)

$

page 3

revised 12/19/2002

1

1 2

2 3

3