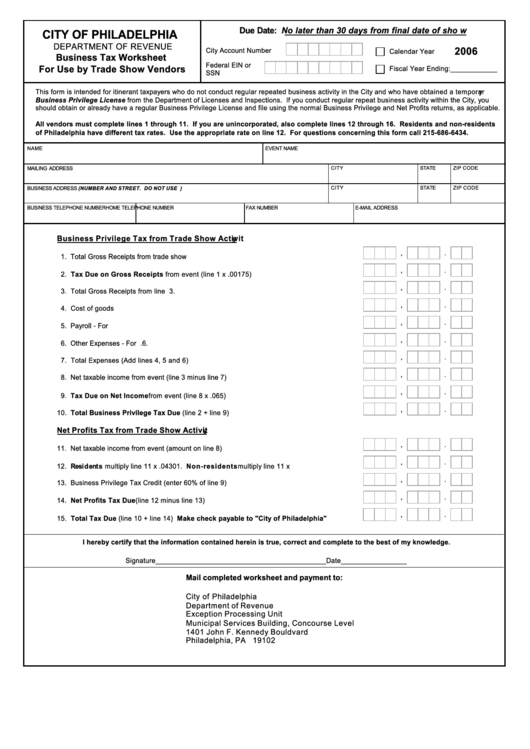

Business Tax Return For Use By Trade Show Vendors - City Of Philadelphia - 2006

ADVERTISEMENT

Due Date: No later than 30 days from final date of show

CITY OF PHILADELPHIA

DEPARTMENT OF REVENUE

2006

City Account Number

Calendar Year

Business Tax Worksheet

Federal EIN or

For Use by Trade Show Vendors

Fiscal Year Ending:____________

SSN

This f orm is intended f or itinerant taxpayers who do not conduct regular repeated business activity in the City and who have obtained a temporary

Busi ness Privilege License f rom the Department of Licenses and Inspections. If you conduct regular repeat business activity within the City, you

should obtain or already have a regular Business Privilege License and file using the normal Business Privilege and Net P rofits returns, as applicable.

All vendors must complete lines 1 through 11. If you are unincorporated, also complete lines 12 through 16. Residents and non-residents

of Philadelphia have different tax rates. Us e the appropriate rate on line 12. For questions concerning this form call 215-686-6434.

NAME

EVENT NAME

MAILING ADDRESS

CITY

STATE

ZIP CODE

CITY

STATE

ZIP CODE

BUSINESS ADDRESS (NUMBER AND STREET. DO NOT USE P. O. BOX NUMBERS.)

BUSINESS TELEPHONE NUMBER

HOME TELEPHONE NUMBER

FAX NUMBER

E-MAIL ADDRESS

Business Privilege Tax from Trade Show Activity

,

.

1. Total Gross Receipts from trade show activity.................. ............... ............... ............... ........1.

,

.

2. Tax Due on Gross Re ceipts from event (line 1 x .00175).............................. ............... .......2.

,

.

3. Total Gross Receipts from line 1............ ............... ............... .............................. ............... ....3.

,

.

4. Cost of goods sold........................ ............... ............... ............... .............................. .............4.

,

.

5. Payroll - For Event................ ............... ............... .............................. ............... ............... ......5.

,

.

6. Other Expenses - For Event............. ............... ............... ............... ............... ............... ..........6.

,

.

7. Total Expenses (Add lines 4, 5 and 6)........................ ............... ............... ............... ..............7.

,

.

8. Net taxable income f rom event (line 3 minus line 7)....................... ............... ............... .........8.

,

.

9. Tax Due on Ne t Income from event (line 8 x .065)....................... ............... ............... ..........9.

,

.

10. Total Business Privilege Tax Due (line 2 + line 9)...................................... ............... .......10.

Net Profits Tax from Trade Show Activity

,

.

11. Net taxable income f rom event (amount on line 8).................... ............... ............... ............11.

,

.

12. Re sidents multiply line 11 x .04301. Non-residents mult iply line 11 x .037716................12.

,

.

13. Business Privilege Tax Credit (enter 60% of line 9).............. ............... .............................. .13.

,

.

14. Ne t Profits Tax Due (line 12 minus line 13).............. ............... ............... ............... ............14.

,

.

15. Total Tax Due (line 10 + line 14) M ake check payable to "City of Philadelphia"...........15.

I hereby certify that the information contained herein is true, correct and complete to the best of my knowledge.

Signature____________________________________________Date_________________

Mail completed worksheet and payment to:

City of Philadelphia

Department of Revenue

Exception Processing Unit

Municipal Services Building, Concourse Level

1401 John F. Kennedy Bouldvard

Philadelphia, PA 19102

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1