Form Molt-2 Marshall County Occupational License Tax For Schools - 2006

ADVERTISEMENT

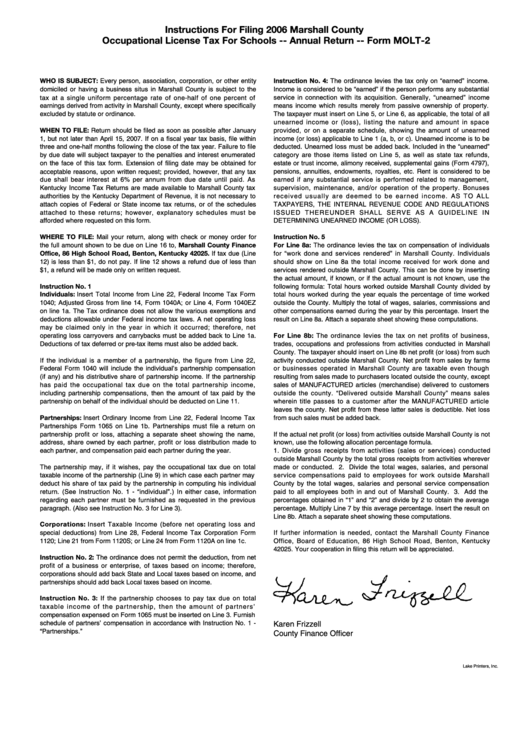

Instructions For Filing 2006 Marshall County

Occupational License Tax For Schools -- Annual Return -- Form MOLT-2

WHO IS SUBJECT: Every person, association, corporation, or other entity

Instruction No. 4: The ordinance levies the tax only on “earned” income.

domiciled or having a business situs in Marshall County is subject to the

Income is considered to be “earned” if the person performs any substantial

tax at a single uniform percentage rate of one-half of one percent of

service in connection with its acquisition. Generally, “unearned” income

earnings derived from activity in Marshall County, except where specifically

means income which results merely from passive ownership of property.

excluded by statute or ordinance.

The taxpayer must insert on Line 5, or Line 6, as applicable, the total of all

unearned income or (loss), listing the nature and amount in space

WHEN TO FILE: Return should be filed as soon as possible after January

provided, or on a separate schedule, showing the amount of unearned

1, but not later than April 15, 2007. If on a fiscal year tax basis, file within

income (or loss) applicable to Line 1 (a, b, or c). Unearned income is to be

three and one-half months following the close of the tax year. Failure to file

deducted. Unearned loss must be added back. Included in the “unearned”

by due date will subject taxpayer to the penalties and interest enumerated

category are those items listed on Line 5, as well as state tax refunds,

on the face of this tax form. Extension of filing date may be obtained for

estate or trust income, alimony received, supplemental gains (Form 4797),

acceptable reasons, upon written request; provided, however, that any tax

pensions, annuities, endowments, royalties, etc. Rent is considered to be

due shall bear interest at 6% per annum from due date until paid. As

earned if any substantial service is performed related to management,

Kentucky Income Tax Returns are made available to Marshall County tax

supervision, maintenance, and/or operation of the property. Bonuses

authorities by the Kentucky Department of Revenue, it is not necessary to

received usually are deemed to be earned income. AS TO ALL

attach copies of Federal or State income tax returns, or of the schedules

TAXPAYERS, THE INTERNAL REVENUE CODE AND REGULATIONS

attached to these returns; however, explanatory schedules must be

ISSUED THEREUNDER SHALL SERVE AS A GUIDELINE IN

afforded where requested on this form.

DETERMINING UNEARNED INCOME (OR LOSS).

WHERE TO FILE: Mail your return, along with check or money order for

Instruction No. 5

the full amount shown to be due on Line 16 to, Marshall County Finance

For Line 8a: The ordinance levies the tax on compensation of individuals

Office, 86 High School Road, Benton, Kentucky 42025. If tax due (Line

for “work done and services rendered” in Marshall County. Individuals

12) is less than $1, do not pay. If line 12 shows a refund due of less than

should show on Line 8a the total income received for work done and

$1, a refund will be made only on written request.

services rendered outside Marshall County. This can be done by inserting

the actual amount, if known, or if the actual amount is not known, use the

Instruction No. 1

following formula: Total hours worked outside Marshall County divided by

Individuals: Insert Total Income from Line 22, Federal Income Tax Form

total hours worked during the year equals the percentage of time worked

1040; Adjusted Gross from line 14, Form 1040A; or Line 4, Form 1040EZ

outside the County. Multiply the total of wages, salaries, commissions and

on line 1a. The Tax ordinance does not allow the various exemptions and

other compensations earned during the year by this percentage. Insert the

deductions allowable under Federal income tax laws. A net operating loss

result on Line 8a. Attach a separate sheet showing these computations.

may be claimed only in the year in which it occurred; therefore, net

operating loss carryovers and carrybacks must be added back to Line 1a.

For Line 8b: The ordinance levies the tax on net profits of business,

Deductions of tax deferred or pre-tax items must also be added back.

trades, occupations and professions from activities conducted in Marshall

County. The taxpayer should insert on Line 8b net profit (or loss) from such

If the individual is a member of a partnership, the figure from Line 22,

activity conducted outside Marshall County. Net profit from sales by farms

Federal Form 1040 will include the individual’s partnership compensation

or businesses operated in Marshall County are taxable even though

(if any) and his distributive share of partnership income. If the partnership

resulting from sales made to purchasers located outside the county, except

has paid the occupational tax due on the total partnership income,

sales of MANUFACTURED articles (merchandise) delivered to customers

including partnership compensations, then the amount of tax paid by the

outside the county. “Delivered outside Marshall County” means sales

partnership on behalf of the individual should be deducted on Line 11.

wherein title passes to a customer after the MANUFACTURED article

leaves the county. Net profit from these latter sales is deductible. Net loss

Partnerships: Insert Ordinary Income from Line 22, Federal Income Tax

from such sales must be added back.

Partnerships Form 1065 on Line 1b. Partnerships must file a return on

partnership profit or loss, attaching a separate sheet showing the name,

If the actual net profit (or loss) from activities outside Marshall County is not

address, share owned by each partner, profit or loss distribution made to

known, use the following allocation percentage formula.

each partner, and compensation paid each partner during the year.

1. Divide gross receipts from activities (sales or services) conducted

outside Marshall County by the total gross receipts from activities wherever

The partnership may, if it wishes, pay the occupational tax due on total

made or conducted. 2. Divide the total wages, salaries, and personal

taxable income of the partnership (Line 9) in which case each partner may

service compensations paid to employees for work outside Marshall

deduct his share of tax paid by the partnership in computing his individual

County by the total wages, salaries and personal service compensation

return. (See Instruction No. 1 - “individual”.) In either case, information

paid to all employees both in and out of Marshall County. 3. Add the

regarding each partner must be furnished as requested in the previous

percentages obtained in “1” and “2” and divide by 2 to obtain the average

paragraph. (Also see Instruction No. 3 for Line 3).

percentage. Multiply Line 7 by this average percentage. Insert the result on

Line 8b. Attach a separate sheet showing these computations.

Corporations: Insert Taxable Income (before net operating loss and

special deductions) from Line 28, Federal Income Tax Corporation Form

If further information is needed, contact the Marshall County Finance

1120; Line 21 from Form 1120S; or Line 24 from Form 1120A on line 1c.

Office, Board of Education, 86 High School Road, Benton, Kentucky

42025. Your cooperation in filing this return will be appreciated.

Instruction No. 2: The ordinance does not permit the deduction, from net

profit of a business or enterprise, of taxes based on income; therefore,

corporations should add back State and Local taxes based on income, and

partnerships should add back Local taxes based on income.

Instruction No. 3: If the partnership chooses to pay tax due on total

taxable income of the partnership, then the amount of partners’

compensation expensed on Form 1065 must be inserted on Line 3. Furnish

schedule of partners’ compensation in accordance with Instruction No. 1 -

Karen Frizzell

“Partnerships.”

County Finance Officer

Lake Printers, Inc.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2