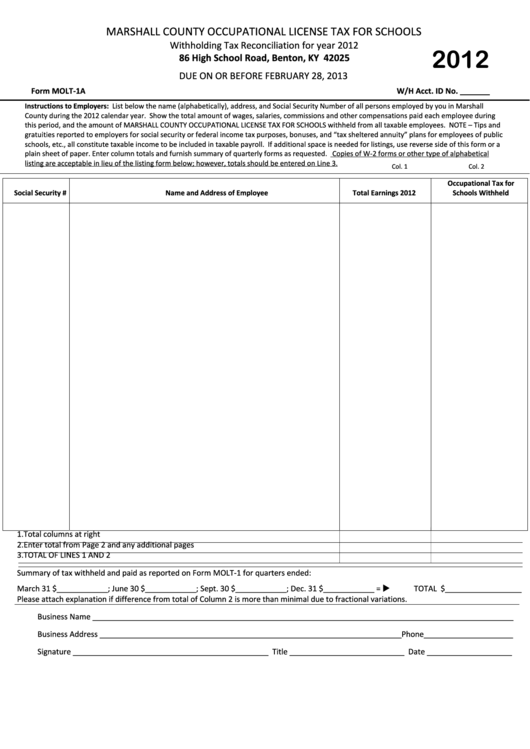

MARSHALL COUNTY OCCUPATIONAL LICENSE TAX FOR SCHOOLS

Withholding Tax Reconciliation for year 2012

2012

86 High School Road, Benton, KY 42025

DUE ON OR BEFORE FEBRUARY 28, 2013

Form MOLT‐1A

W/H Acct. ID No. _______

Instructions to Employers: List below the name (alphabetically), address, and Social Security Number of all persons employed by you in Marshall

County during the 2012 calendar year. Show the total amount of wages, salaries, commissions and other compensations paid each employee during

this period, and the amount of MARSHALL COUNTY OCCUPATIONAL LICENSE TAX FOR SCHOOLS withheld from all taxable employees. NOTE – Tips and

gratuities reported to employers for social security or federal income tax purposes, bonuses, and “tax sheltered annuity” plans for employees of public

schools, etc., all constitute taxable income to be included in taxable payroll. If additional space is needed for listings, use reverse side of this form or a

plain sheet of paper. Enter column totals and furnish summary of quarterly forms as requested. Copies of W‐2 forms or other type of alphabetical

listing are acceptable in lieu of the listing form below; however, totals should be entered on Line 3.

Col. 1

Col. 2

Occupational Tax for

Social Security #

Name and Address of Employee

Total Earnings 2012

Schools Withheld

1. Total columns at right

2. Enter total from Page 2 and any additional pages

3. TOTAL OF LINES 1 AND 2

Summary of tax withheld and paid as reported on Form MOLT‐1 for quarters ended:

March 31 $____________; June 30 $____________; Sept. 30 $____________; Dec. 31 $____________ =

TOTAL $__________________

Please attach explanation if difference from total of Column 2 is more than minimal due to fractional variations.

Business Name ___________________________________________________________________________________________________

Business Address _______________________________________________________________________Phone_____________________

Signature ______________________________________________ Title ___________________________ Date ____________________

1

1 2

2