Form 2a - Detail Sheet Annual Unclaimed Property Report - 2001

ADVERTISEMENT

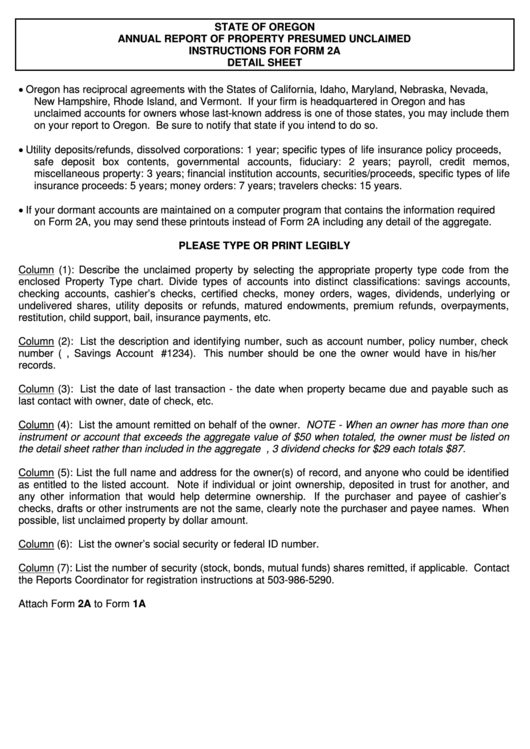

STATE OF OREGON

ANNUAL REPORT OF PROPERTY PRESUMED UNCLAIMED

INSTRUCTIONS FOR FORM 2A

DETAIL SHEET

• Oregon has reciprocal agreements with the States of California, Idaho, Maryland, Nebraska, Nevada,

New Hampshire, Rhode Island, and Vermont. If your firm is headquartered in Oregon and has

unclaimed accounts for owners whose last-known address is one of those states, you may include them

on your report to Oregon. Be sure to notify that state if you intend to do so.

• Utility deposits/refunds, dissolved corporations: 1 year; specific types of life insurance policy proceeds,

safe deposit box contents, governmental accounts, fiduciary: 2 years; payroll, credit memos,

miscellaneous property: 3 years; financial institution accounts, securities/proceeds, specific types of life

insurance proceeds: 5 years; money orders: 7 years; travelers checks: 15 years.

• If your dormant accounts are maintained on a computer program that contains the information required

on Form 2A, you may send these printouts instead of Form 2A including any detail of the aggregate.

PLEASE TYPE OR PRINT LEGIBLY

Column (1): Describe the unclaimed property by selecting the appropriate property type code from the

enclosed Property Type chart. Divide types of accounts into distinct classifications: savings accounts,

checking accounts, cashier’s checks, certified checks, money orders, wages, dividends, underlying or

undelivered shares, utility deposits or refunds, matured endowments, premium refunds, overpayments,

restitution, child support, bail, insurance payments, etc.

Column (2): List the description and identifying number, such as account number, policy number, check

number (i.e., Savings Account #1234). This number should be one the owner would have in his/her

records.

Column (3): List the date of last transaction - the date when property became due and payable such as

last contact with owner, date of check, etc.

Column (4): List the amount remitted on behalf of the owner. NOTE - When an owner has more than one

instrument or account that exceeds the aggregate value of $50 when totaled, the owner must be listed on

the detail sheet rather than included in the aggregate i.e., 3 dividend checks for $29 each totals $87.

Column (5): List the full name and address for the owner(s) of record, and anyone who could be identified

as entitled to the listed account. Note if individual or joint ownership, deposited in trust for another, and

any other information that would help determine ownership. If the purchaser and payee of cashier’s

checks, drafts or other instruments are not the same, clearly note the purchaser and payee names. When

possible, list unclaimed property by dollar amount.

Column (6): List the owner’s social security or federal ID number.

Column (7): List the number of security (stock, bonds, mutual funds) shares remitted, if applicable. Contact

the Reports Coordinator for registration instructions at 503-986-5290.

Attach Form 2A to Form 1A

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2