Form St-8 - Tire User Fee - 2009

Download a blank fillable Form St-8 - Tire User Fee - 2009 in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form St-8 - Tire User Fee - 2009 with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

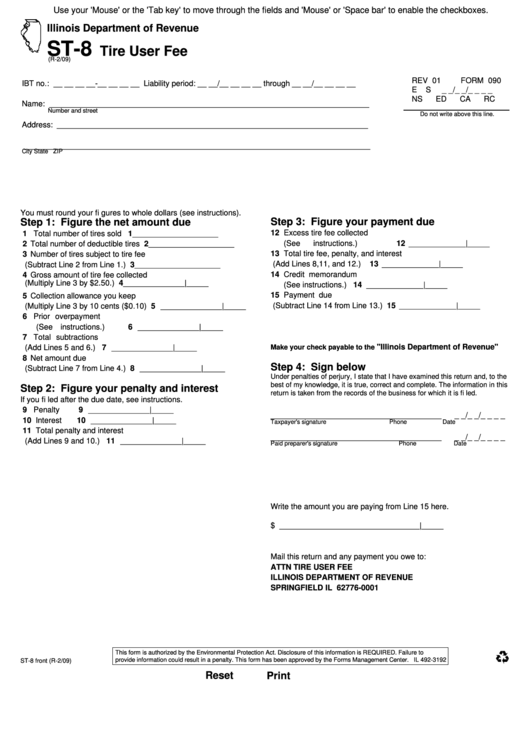

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

ST-8

Tire User Fee

(R-2/09)

REV 01

FORM 090

IBT no.: __ __ __ __-__ __ __ __

Liability period: __ __/__ __ __ __ through __ __/__ __ __ __

E

S

_ _/_ _/_ _ _ _

NS

ED

CA

RC

Name: _________________________________________________________________________

Number and street

Do not write above this line.

Address: _______________________________________________________________________

_______________________________________________________________________________

City

State

ZIP

You must round your fi gures to whole dollars (see instructions).

Step 3: Figure your payment due

Step 1: Figure the net amount due

12 Excess tire fee collected

1 Total number of tires sold

1

______________________

(See instructions.)

12 _____________|_____

2 Total number of deductible tires

2

______________________

13 Total tire fee, penalty, and interest

3 Number of tires subject to tire fee

(Add Lines 8,11, and 12.)

13 _____________|_____

(Subtract Line 2 from Line 1.)

3

______________________

14 Credit memorandum

4 Gross amount of tire fee collected

(See instructions.)

14 _____________|_____

(Multiply Line 3 by $2.50.)

4 ______________|_____

15 Payment due

5 Collection allowance you keep

(Subtract Line 14 from Line 13.)

15 _____________|_____

(Multiply Line 3 by 10 cents ($0.10)

5 ______________|_____

6 Prior overpayment

(See instructions.)

6 ______________|_____

7 Total subtractions

"Illinois Department of Revenue"

(Add Lines 5 and 6.)

7 ______________|_____

Make your check payable to the

8 Net amount due

Step 4: Sign below

(Subtract Line 7 from Line 4.)

8 ______________|_____

Under penalties of perjury, I state that I have examined this return and, to the

best of my knowledge, it is true, correct and complete. The information in this

Step 2: Figure your penalty and interest

return is taken from the records of the business for which it is fi led.

If you fi led after the due date, see instructions.

9 Penalty

9 ______________|_____

_______________________________________

_ _/_ _/_ _ _ _

10 Interest

10 ______________|_____

Taxpayer's signature

Phone

Date

11 Total penalty and interest

_______________________________________

_ _/_ _/_ _ _ _

(Add Lines 9 and 10.)

11 ______________|_____

Paid preparer's signature

Phone

Date

Write the amount you are paying from Line 15 here.

$ ________________________________|_____

Mail this return and any payment you owe to:

ATTN TIRE USER FEE

ILLINOIS DEPARTMENT OF REVENUE

SPRINGFIELD IL 62776-0001

This form is authorized by the Environmental Protection Act. Disclosure of this information is REQUIRED. Failure to

provide information could result in a penalty. This form has been approved by the Forms Management Center. IL 492-3192

ST-8 front (R-2/09)

Reset

Print

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1