Form St-8 - Tire User Fee

Download a blank fillable Form St-8 - Tire User Fee in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form St-8 - Tire User Fee with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

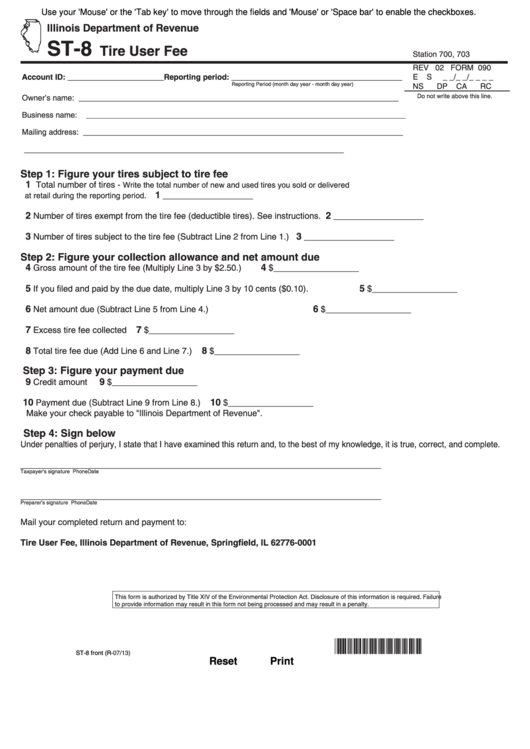

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

ST-8

Tire User Fee

Station 700, 703

REV 02 FORM 090

Account ID: ______________________Reporting period: _______________________________________

E S _ _/_ _/_ _ _ _

Reporting Period (month day year - month day year)

NS DP CA RC

Do not write above this line.

Owner’s name: _________________________________________________________________________

Business name: _________________________________________________________________________

Mailing address: _________________________________________________________________________

_________________________________________________________________________

Step 1: Figure your tires subject to tire fee

1

Total number of tires -

Write the total number of new and used tires you sold or delivered

1

___________________

at retail during the reporting period.

2

2

Number of tires exempt from the tire fee (deductible tires). See instructions.

___________________

3

3

Number of tires subject to the tire fee (Subtract Line 2 from Line 1.)

___________________

Step 2: Figure your collection allowance and net amount due

4

4

Gross amount of the tire fee (Multiply Line 3 by $2.50.)

$__________________

5

5

If you filed and paid by the due date, multiply Line 3 by 10 cents ($0.10).

$__________________

6

6

Net amount due (Subtract Line 5 from Line 4.)

$__________________

7

7

Excess tire fee collected

$__________________

8

8

Total tire fee due (Add Line 6 and Line 7.)

$__________________

S tep 3: Figure your payment due

9

9

Credit amount

$__________________

1 0

10

Payment due (Subtract Line 9 from Line 8.)

$__________________

Make your check payable to "Illinois Department of Revenue".

Step 4: Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

____________________________________________________________________________

Phone

Taxpayer's signature

Date

____________________________________________________________________________

Phone

Preparer's signature

Date

Mail your completed return and payment to:

Tire User Fee, Illinois Department of Revenue, Springfield, IL 62776-0001

This form is authorized by Title XIV of the Environmental Protection Act. Disclosure of this information is required. Failure

to provide information may result in this form not being processed and may result in a penalty.

*309011110*

ST-8 front (R-07/13)

Reset

Print

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1