Reset Form

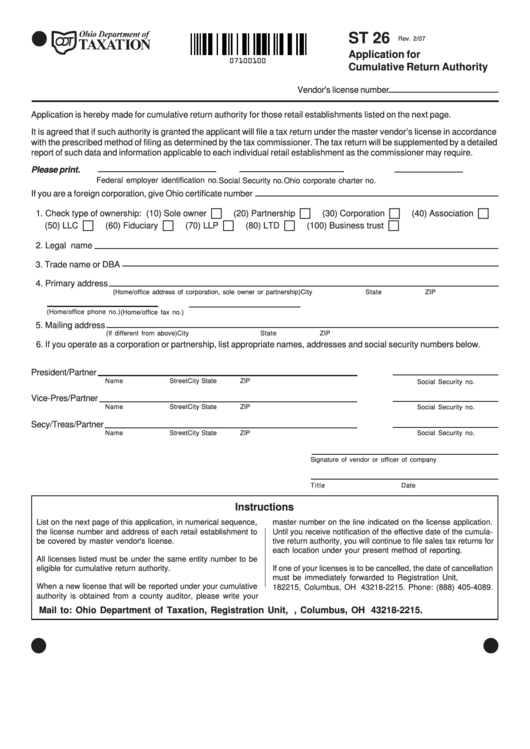

ST 26

Rev. 2/07

Application for

07100100

Cumulative Return Authority

Vendor's license number

Application is hereby made for cumulative return authority for those retail establishments listed on the next page.

It is agreed that if such authority is granted the applicant will file a tax return under the master vendor’s license in accordance

with the prescribed method of filing as determined by the tax commissioner. The tax return will be supplemented by a detailed

report of such data and information applicable to each individual retail establishment as the commissioner may require.

Please print.

Federal employer identification no.

Social Security no.

Ohio corporate charter no.

If you are a foreign corporation, give Ohio certificate number

1. Check type of ownership: (10) Sole owner

(20) Partnership

(30) Corporation

(40) Association

(50) LLC

(60) Fiduciary

(70) LLP

(80) LTD

(100) Business trust

2. Legal name

3. Trade name or DBA

4. Primary address

(Home/office address of corporation, sole owner or partnership)

City

State

ZIP

(Home/office phone no.)

(Home/office fax no.)

5. Mailing address

(If different from above)

City

State

ZIP

6. If you operate as a corporation or partnership, list appropriate names, addresses and social security numbers below.

President/Partner

Name

Street

City

State

ZIP

Social Security no.

Vice-Pres/Partner

Name

Street

City

State

ZIP

Social Security no.

Secy/Treas/Partner

Name

Street

City

State

ZIP

Social Security no.

Signature of vendor or officer of company

Title

Date

Instructions

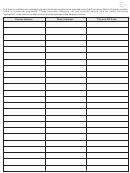

List on the next page of this application, in numerical sequence,

master number on the line indicated on the license application.

the license number and address of each retail establishment to

Until you receive notification of the effective date of the cumula-

be covered by master vendor's license.

tive return authority, you will continue to file sales tax returns for

each location under your present method of reporting.

All licenses listed must be under the same entity number to be

eligible for cumulative return authority.

If one of your licenses is to be cancelled, the date of cancellation

must be immediately forwarded to Registration Unit, P.O. Box

When a new license that will be reported under your cumulative

182215, Columbus, OH 43218-2215. Phone: (888) 405-4089.

authority is obtained from a county auditor, please write your

Mail to: Ohio Department of Taxation, Registration Unit, P.O. Box 182215, Columbus, OH 43218-2215.

1

1 2

2