Form St 26 - Application For Cumulative Return Authority

ADVERTISEMENT

S

O

Prescribed Form

TATE OF

HIO

ST 26

D

T

EPARTMENT OF

AXATION

A

C

R

A

PPLICATION FOR

UMULATIVE

ETURN

UTHORITY

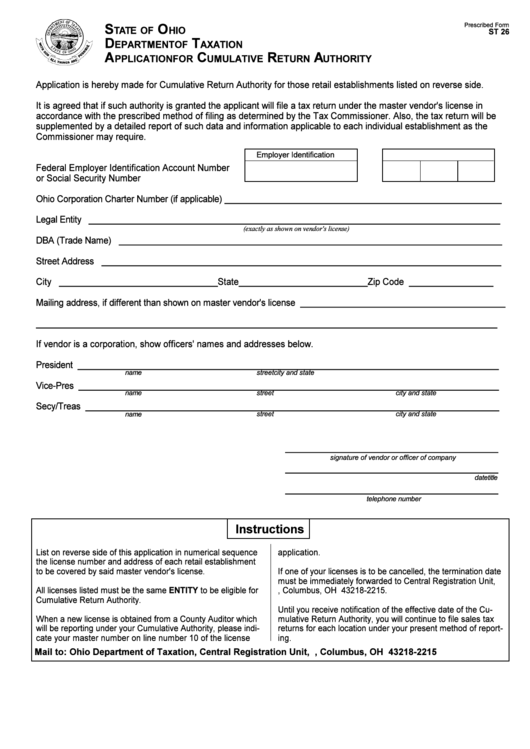

Application is hereby made for Cumulative Return Authority for those retail establishments listed on reverse side.

It is agreed that if such authority is granted the applicant will file a tax return under the master vendor's license in

accordance with the prescribed method of filing as determined by the Tax Commissioner. Also, the tax return will be

supplemented by a detailed report of such data and information applicable to each individual establishment as the

Commissioner may require.

Employer Identification No.

Social Security No.

Federal Employer Identification Account Number

or Social Security Number

Ohio Corporation Charter Number (if applicable) _________________________________________________________

Legal Entity _____________________________________________________________________________________

(exactly as shown on vendor's license)

DBA (Trade Name) _______________________________________________________________________________

Street Address __________________________________________________________________________________

City ________________________________ State__________________________ Zip Code _________________

Mailing address, if different than shown on master vendor's license __________________________________________

_________________________________________________________________________________________________

If vendor is a corporation, show officers' names and addresses below.

President _______________________________________________________________________________________

name

street

city and state

Vice-Pres _______________________________________________________________________________________

name

street

city and state

Secy/Treas _____________________________________________________________________________________

street

city and state

name

___________________________________________

signature of vendor or officer of company

___________________________________________

title

date

___________________________________________

telephone number

Instructions

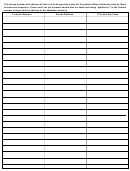

List on reverse side of this application in numerical sequence

application.

the license number and address of each retail establishment

to be covered by said master vendor's license.

If one of your licenses is to be cancelled, the termination date

must be immediately forwarded to Central Registration Unit,

All licenses listed must be the same ENTITY to be eligible for

P.O. Box 182215, Columbus, OH 43218-2215.

Cumulative Return Authority.

Until you receive notification of the effective date of the Cu-

When a new license is obtained from a County Auditor which

mulative Return Authority, you will continue to file sales tax

will be reporting under your Cumulative Authority, please indi-

returns for each location under your present method of report-

cate your master number on line number 10 of the license

ing.

Mail to: Ohio Department of Taxation, Central Registration Unit, P.O. Box 182215, Columbus, OH 43218-2215

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2