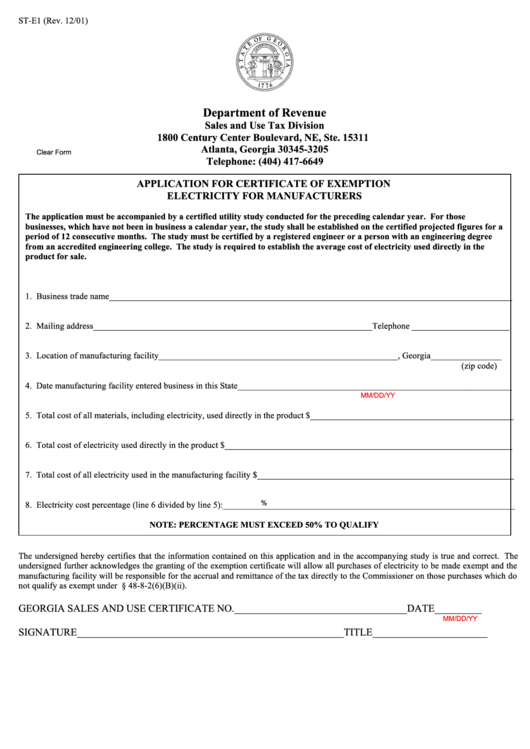

ST-E1 (Rev. 12/01)

Department of Revenue

Sales and Use Tax Division

1800 Century Center Boulevard, NE, Ste. 15311

Atlanta, Georgia 30345-3205

Clear Form

Telephone: (404) 417-6649

APPLICATION FOR CERTIFICATE OF EXEMPTION

ELECTRICITY FOR MANUFACTURERS

The application must be accompanied by a certified utility study conducted for the preceding calendar year. For those

businesses, which have not been in business a calendar year, the study shall be established on the certified projected figures for a

period of 12 consecutive months. The study must be certified by a registered engineer or a person with an engineering degree

from an accredited engineering college. The study is required to establish the average cost of electricity used directly in the

product for sale.

1. Business trade name___________________________________________________________________________________________

2. Mailing address_______________________________________________________________Telephone ______________________

3. Location of manufacturing facility______________________________________________________, Georgia________________

(zip code)

4. Date manufacturing facility entered business in this State______________________________________________________________

MM/DD/YY

5. Total cost of all materials, including electricity, used directly in the product $______________________________________________

6. Total cost of electricity used directly in the product $_________________________________________________________________

7. Total cost of all electricity used in the manufacturing facility $__________________________________________________________

%

8. Electricity cost percentage (line 6 divided by line 5):__________________________________________________________________

NOTE: PERCENTAGE MUST EXCEED 50% TO QUALIFY

The undersigned hereby certifies that the information contained on this application and in the accompanying study is true and correct. The

undersigned further acknowledges the granting of the exemption certificate will allow all purchases of electricity to be made exempt and the

manufacturing facility will be responsible for the accrual and remittance of the tax directly to the Commissioner on those purchases which do

not qualify as exempt under O.C.G.A. § 48-8-2(6)(B)(ii).

GEORGIA SALES AND USE CERTIFICATE NO._________________________________DATE_________

MM/DD/YY

SIGNATURE___________________________________________________TITLE______________________

1

1