Form Sw-3 - Reconciliation Of Stow Income Tax Withheld From Wages

ADVERTISEMENT

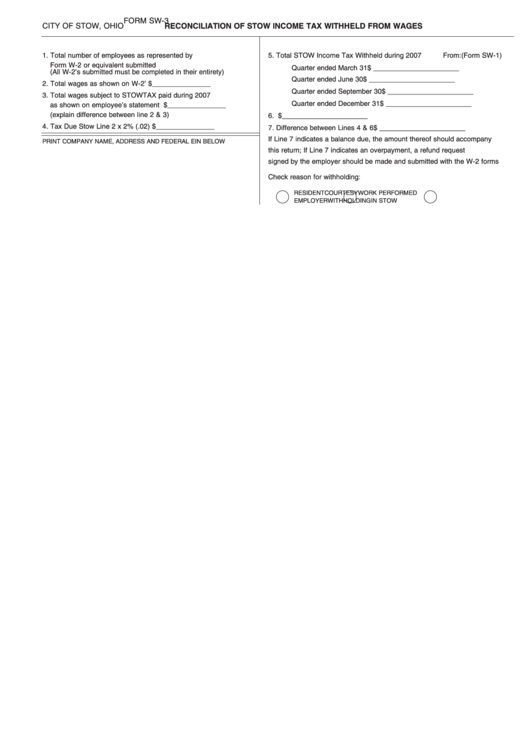

FORM SW-3

CITY OF STOW, OHIO

RECONCILIATION OF STOW INCOME TAX WITHHELD FROM WAGES

1. Total number of employees as represented by

5. Total STOW Income Tax Withheld during 2007

From: (Form SW-1)

Form W-2 or equivalent submitted herewith ...._______________

Quarter ended March 31

$ ______________________

(All W-2’s submitted must be completed in their entirety)

Quarter ended June 30

$ ______________________

2. Total wages as shown on W-2’s .................... $_______________

Quarter ended September 30

$ ______________________

3. Total wages subject to STOW TAX paid during 2007

Quarter ended December 31

$ ______________________

as shown on employee’s statement W-2 ...... $_______________

(explain difference between line 2 & 3)

6. Total .................................................................. $ ______________________

4. Tax Due Stow Line 2 x 2% (.02).................... $_______________

7. Difference between Lines 4 & 6

$ ______________________

If Line 7 indicates a balance due, the amount thereof should accompany

PRINT COMPANY NAME, ADDRESS AND FEDERAL EIN BELOW

this return; If Line 7 indicates an overpayment, a refund request

signed by the employer should be made and submitted with the W-2 forms

Check reason for withholding:

RESIDENT

COURTESY

WORK PERFORMED

EMPLOYER

WITHHOLDING

IN STOW

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1