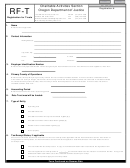

9.

Tax-Exempt Status

Check one of the boxes below which describes the corporation’s tax-exempt status application with the Internal Revenue Service. After review of

an application for exempt status, the Internal Revenue Service will mail the applicant a “determination letter.” The letter states the corporation’s

tax-exempt status. Please note that an application for tax-exempt status is different than an application for an employer identification number.

The corporation holds IRS tax-exempt status. A copy of the IRS determination letter is attached to this registration form.

The corporation applied for tax-exempt status on

/

/

but a determination letter has not been received from the IRS.

A copy of the IRS determination letter will be sent to the Charitable Activities Section upon receipt.

The corporation has not applied for tax-exempt status. State the reason for not applying: __________________________

10.

Fundraising

Yes

No

Is the corporation a party to a contract involving person-to-person, advertising, vending machine or telephone fund-

raising in Oregon? If yes, write the name of the fund-raising firm(s) who conducts the campaign(s):

_________________________________________________________________________________________

11.

Charitable Gaming

Yes

No

Does the corporation conduct bingo, raffle or Monte Carlo event?

12.

Individual to Contact with Questions

Provide contact information for the person to be contacted regarding this registration.

Name

Position

Phone

Mailing Address

Key Officials

13.

List of Officers, Directors, Trustees and Key Employees – List each person who held one of these positions at any time during the year. The

Executive Director is considered to be a Key Employee. Oregon public benefit corporations must have at least 3 directors. Attach additional

sheets if necessary.

Name

Position

Phone

Mailing Address

14.

Required Documents

Attach the following documents to this registration form. If a document is unavailable, attach an explanation.

•

Filed articles of incorporation or Corporation Division acknowledgement letter with attached copy of articles of incorporation

•

Signed and dated bylaws

•

IRS determination letter, if applicable

In addition to the required documentation, the corporation may submit printed brochures, reports or newsletters. The material will be included in the

public record for the corporation and made available to public inspection.

Under penalties of perjury, I declare that I have examined this form, including any attachments, and to the best of my knowledge and

Please

belief, it is true, correct, and complete.

Sign

Þ

Here

_______________________________________________

________________________________________________

Signature of Officer or Representative Name

Date

_______________________________________________

________________________________________________

Printed Name

Title

revised 6/1/2001

2

1

1 2

2 3

3 4

4 5

5